There may be affiliate links in this article on how to save money and travel, read the full disclaimer here.

Imagine what it would be like if you could save £30,000 a year and travel…

You probably know that £30,000 a year may seem like a ridiculous amount to some people, and like peanuts to others. But for teachers in the UK this is literally impossible… literally.

So how do we do it?

As you read this web page you’ll see it’s beacuse of two things:

- We are international teachers

- We set ourselves possibly the most boring & cringy sounding word in the world… a budget

So grab a cuppa and read on to find out how to save money and travel.

What is Monthly Budgeting?

Planning what you are going to spend money on for the next month.

Some people hear the word budget and associate a stingy prick that is tighter than Tom Cruise’s T-shirt on Dwayne Johnson.

Now, let me ask you this, “Do you like to eat out? Or do you like to drink Chateaux Neuf De Pape? Or do you like to travel?”

Wouldn’t it be amazing to do more of the things that you love?… Well, that’s what a budget can allow you to do…

“The first step is acceptance.”

But it Sounds Sooooooo Boring

I’m not gunna lie, it ain’t all rainbow and butterflies!

But it can actually be quite enjoyable or at worst relatively painless. Here’s why:

You get to plan fun things that you want to do!

Scientific FACT:

Planning fun things helps to improve happiness levels… Not only do you get a “buzz” when you plan it, you also get a buzz when you do it.

2 for the price of 1 amigo!

As you absorb this information, you’ll discover how to save money and travel.

Who Should Use a Monthly Household Budget?

Everyone!

The right question should be… “Do you want to live your entire life working paycheck to paycheck?”

If you answered yes to that, then by all means never set a budget and wave your hard earned cash goodbye. You will quickly find there’s not enough month at the end of the money.

Here is a short list of people that should set a budget:

- Anyone that wants to retire before 82 years old

- Someone receiving benefits each month

- A city banker earning 7 figures a year

- Football players that have earnt more £’s than seconds that have walked the planet.

I think you get the point…

Use this template to find out how to save money and travel.

How to Save Money and Travel- Organise the Budget

Here is the very advanced process we use to set a budget:

- Think about what we are going to do next month

- Write down how much this will cost (roughly)

It is obviously going to be personal preference on what your outgoings will be. But most people will have these main categories:

- Accomodation

- Food

- Entertainment

- Transport/ Travel

- Other

It doesn’t have to be hard!

KISS = Keep It Simple Stupid

Top Tips:

- If you want to save a certain amount of money put this aside FIRST!!

- Find ways to make more money. There are a ton of great side hustles suited for teachers.

- Use zero based budgeting to make sure you account for every penny.

- Work out how much money you have to spend and decide what your main priorities are (it’s important to understand your own values and life vision… click here to find out more about this)

- Ask yourself “How can I afford this?” instead of saying “I can’t afford that”. Your mind will find ways to change spending habits if you actually want something instead of switching your brain off.

- Start thinking about how you will use the money you save. This will give you a reason WHY and if you’ve ever spoken to a 3-year-old you will know explaining “why” is important to human beings.

Personal Financial Statement Template

Are you beginning to see how to save money and travel?

Setting a budget can really help right?

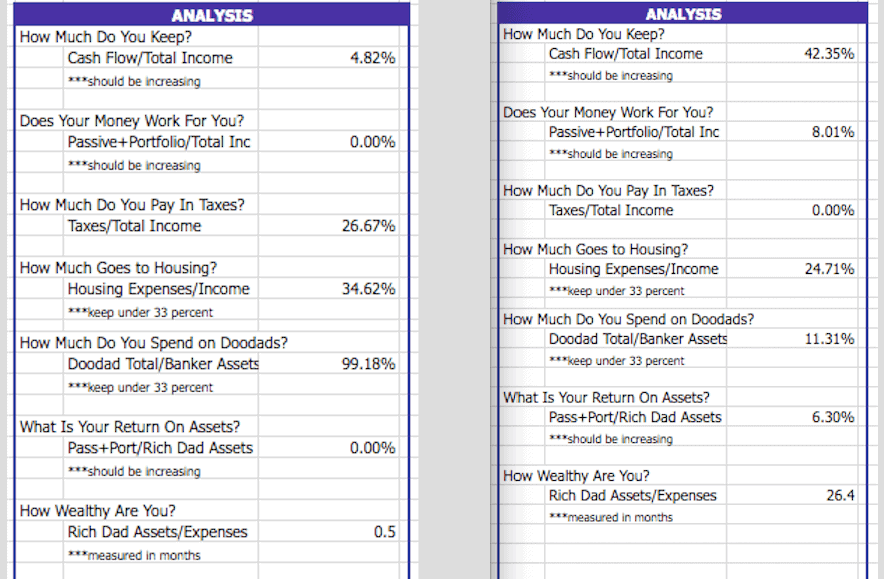

As you are about to find out…budget setting is NOTHING compared to working out you personal financial statement.

Drift back to a time when you didn’t have to worry about finances… If you are like 99% of the world you were thinking about your childhood (or maybe babyhood!)

Doing this step can help you experience these feelings again.

I’m not going to pretend like completing this is super easy but I GUARANTEE, if you do this you will learn everything that you need to know about your current financial situation.

You can’t really know where you’re going until you know where you’ve been.

You probably know that successful people are not just born successful. They do things that “normal people” aren’t prepared to do.

If there is only one thing you do today then let it be this…

Get this template and fill it in! Like right now… if you wait until tomorrow it will never come

Start With a Simple Monthly Budget Worksheet

The further on you read the more you’ll begin to understand how much you can learn about yourself from doing this task properly.

The idea came to me from reading Rich Dad Poor Dad in 2014 (Yes, I was 25 years old before I even thought about setting a budget).

Since completing this it has made me more aware of every financial decision I make.

Therefore, it’s crucial for how to save money and travel.

And it is incredible to see how much our financial statement has changed since then (the first statement is June 2014, the second is December 2018)…

Look at your past month’s bank statements and work out where last months expenses went right now. You can thank me later…

If you aim for nothing you will hit it every time.

Zig Ziglar

Track Previous Months Expenses

“Why do you keep telling me to do boring things?!”

I’m not telling you to do it I’m just showing you what I do.

Like you read earlier… I like to keep the monthly budget as simple as possible.

This means I can do it when sitting at the pool on my phone or in a notebook. The more complicated it is the less likely I will do it!

Sarah and I sit down every 3 months to reflect on our goals and to set the next 3 months goals.

So this time is crucial to think about how to save money and travel.

I use this time to check our income and expenses over the past 3 months and compare this to our budgets.

The first time I did this I was really slack and just guestimated figures.

I eventually got around to checking bank statements and going into more detail.

It has been EYE POPPINGLY opening to say the least!

We were spending over £650 PER month on alcohol… That’s around £8,000 a year on feeling like s***!

Money well spent?… I don’t think so.

We were able to cut down on things that weren’t bringing us happiness (even though we thought they were), which meant we had more money to spend on doing things we love (i.e. travelling!)

What Does Our Statement Look Like?

Can you recall a time when someone has told you about budgeting?

If you are like me you probably just want to see an example.

So here is what our package is as international teachers in Qatar.

- £3,000 a month (with stipend positions)

- Accomodation is provided

- We get our phone bill & laptop included

- 1 Return flight home a year

- Tax-free earnings (the biggie in the Middle East)

= £6,000 a month income roughly

Expenses (on average)

- House expenses (bills, furniture, repairs, cleaning etc.)- £500

- Transport- £500

- Travel- £800

- Food/ drink/ health- £1,000

- Entertainment- £200

=£3,000 a month expenses

Travel and our health is important to us. It means we often have months where we spend less money to allow for trips to places that we want to go during the breaks.

How can I afford this? Helps your brain find a solution

Make Time Online Summary

Budgets are NOT sexy.

But they do NOT have to be boring.

Now, I would like to help you experience what it’s like to get your finances in check.

Have you noticed yet that budgeting not only does this but is also a way to plan exciting things in the upcoming month?

Making a budget each month is more important than ketchup is to a bacon butty.

When you try this free financial statement you will discover why we continue to use it, years after we started.

If you fail to plan… you are planning to fail.

Keep changing for the better,

Mike

Note- we do not just have our money sitting in a bank account. We set up a plan for what we wanted to use the money for and our goals have helped to hold us accountable. Without this plan, we probably would have spent this money on “stuff” because that is human nature! That’s the key for how to save money and travel

p.s. If you are interested in making money online to free up your time, have a look at my #1 recommended program here, which I am currently using.

p.p.s. If you have any questions or thoughts please feel free to drop a comment below… or send me a message on WA here

I was so averse to even paying attention to my money for so many years. Struggling with student loan debt made me feel so depressed every time I looked at my finances. But in the last couple years I’ve realized that the more I actually pay attention to it and take action to reduce that debt, the better my situation gets and, in turn, the better I feel. It’s truly amazing how far a budget can take you and how much it helps you realize where your money is going and how you can change your habits to make it go where you want it to!

Hi Tucker,

Yes, that’s so true.

It’s hard to address reality but it certainly helps!

I’ve found using the personal financial statement has helped me so much and getting a clearer focus on our spending and goals.

Mike

I would say that this article is not only a benefit for teachers it is also beneficial for all the full time workers out there. This article has everything you needed to know about budgeting.

It teaches you what is budgeting and how to do monthly budgeting in a right way.

It was really easy to understand and read. Thank you so much for sharing this article.

Hi Sujandar,

Thanks so much for your kind words again. Please do let me know if you have any questions.

Mike

As someone who has worked as a teacher in the UK, I can totally agree with you that it is virtually impossible to save very much at all on a teacher’s salary!

I really wish that I had thought of working as an international teacher when I was your age (which sadly I’m not), but at that age I had two children and subsequently two more, so I guess that would have worked for me. I would be interested to know if many international teachers also have a young family.

And I do agree with you that it is important to set a budget, although I must confess that it is not all that easy to do with a young family!

Very many thanks for your really encouraging post.

Chrissie 🙂

Hi Chrissie,

Yes, there are lots of young families that teach internationally. Lot’s of people have their children abroad. It opens up the possibility of having a “nanny” or to employ someone around the house to cook/ clean.

Opened our eyes to how many people do this.

I’ve found checking our expenses and using the personal financial statement has really helped to find areas that we were spending money on things that we didn’t want.

This has freed up money to spend on more things that do want to do (travel!)

Let us know if you have any questions about the financial statement!

Mike

Am not a teacher but I will take this and use it on my self too.this is a very great and useful information, I love the tips on how to save money am going to put it into practice. Checking ones expenses and budgets is important, have always known about having to make plan. Thanks for this information.

Hi Sandra,

I hope it helps!

The principles are more important than what your profession is.

Let me know if there are any questions you have about the personal finance statement.

Mike

I really think its awesome how you two are international teachers. It gives you the flexibility to travel and teach at the same time, while having a complete understanding of how to budget and where you should be spending money. That’s not easy for most people, but you have it down. It’s really simple if we take the time to stand back and say look “where are we going on our next month, and how much do we need to budget for that trip?” The KISS method is a great way ti burn it into my brain, and remember those two very advanced budgeting processes. I agree that when you plan an event and you execute on it, it makes you feel do much more happier.

When I was younger, I never planned a thing – used to just wing it. But nowadays, it’s much different, and I enjoy the planning part, especially if it will keep me grounded and setting out on the goals I have.

Your monthly budget worksheet really opened my eyes on how I need to be setting it up for myself, and I really thank you for breaking that down for me visually and with specific details. I’m bookmarking this page so I can come back to it and fill in my own budgeting analysis templates. Thank you!

Hey Michael,

Thanks so much for that! I agree so much about the winging it part. I always used to wing it… funny thing was I never seemed to have any month left at the end of the money!!

I hope the budget worksheet helps let me know if you have any questions about it, and obviously feel free to change it to suit your own lifestyle!

My names Qaalid. This article has everything you needed to know about budgeting.

And I agree with you that it is important to set a budget.tank you sa much mike

Thanks Qaalid, I’m glad it helped!

Hi Mike

Great post. Lots of useful suggestions there.

We replicated your alcohol budget shock when we started doing this some years ago – but our shock cost was takeaways and eating out!

Glad it helped Richie! It is a bit of an eye openeer right?!