Note I am not a financial advisor I am only giving my opinions on the Millionaire Teacher book review. There are also affiliate links in this article, read the full disclaimer here.

As you read every word of this review you will become amazed at how a teacher has become a millionaire!

Yes, you read that right!

Andrew Hallam really does have an extraordinary story. But the methods he used to get where he is are very ordinary.

Millionaire Teacher Book Review – The Overview and Rankings

- Name: Millionaire Teacher- The Nine Rules of Wealth You Should Have Learned in School

- Author: Andrew Hallam 86 out of 100

- Originality: 80 out of 100

- Practical methods: 92 out of 100

- Enjoyability: 55 out of 100

- Price: Kindle $13.16/ Paperback $15.50

- Maketimeonline.com Rating: 78 out of 100

Pros and Cons

Pros

- Inspirational story

- Great advice for the “average” person

- Makes you realise it is possible to build wealth no matter what your income is

- Uses some excellent facts and opens your eyes to investing in the stock market

- Great practical tips throughout the book

- Gives you step by step advice of how you can start TODAY!

Cons

- The advice is not going to help you retire really young (unless you are a child reading this)

- Gets a bit technical later on – makes it less enjoyable (especially if you’re new to investing)

- Quite generic advice and leaves you with questions if you don’t fit certain criteria (i.e. what to do if you’re an expat/ don’t live in one of the 4 countries he mentions… luckily he has another book for that!)

- Only really shows one possibility of investing (invest in index funds

Who is Millionaire Teacher for?

Let me ask you this, “are you interested in earning a passive income?”

Andrew demonstrates the importance of living frugally and investing in the stock market when young. If you read this book in school you would be laughing right now.

People this book is for:

- Anyone that wants to achieve financial independence

- Anyone that wants to invest but doesn’t know where to start

- People that find there’s not enough month at the end of the money

- Low income workers

- HIGH income workers

- Ideal for young adults (but there is important advice for older generations too!)

Are you beginning to see how the millionaire teacher book review could help?

What is Millionaire Teacher about?

Since you’re still here I’m going to assume that you want to learn more about investing in the stock market.

The methods Mr Hallam mentions in the book have been proven by numerous studies to be the BEST and easiest way to invest money to grow wealth.

Hallam will show you ways that you can invest in the US, UK and even Chinese stock market.

If you’re like me, you want to find multiple streams of passive income.

This method is possibly the MOST passive form of income I have found to date.

As you keep reading this webpage, you will feel more and more amazed at how Andrew Hallam became a millionaire and some of the (slightly insane) things he used to do to save more money, pay off his debts and invest more.

This includes when he used to ride his bike 70 miles a day to and from work.

He did this because he could rent a basement for $350 a month out of town and avoid paying for fuel in his 20 year old $1,300 volkswagen (which he sold for $1,800 2 years later).

There is lots of great advice in here but there are 3 big lessons I want to share in this millionaire teacher book review…

1. What car to buy?

Imagine what it would be like if you could use a car for a few years and be paid to use it?

Rather than leasing a car, Andrew Hallam has an EYE POPPING tip to purchasing a car!

The secret is:

Buy second-hand Japanese cars that have low mileage and are well maintained…

Monkey simple!

Japanese cars like Toyota and Nissan typically hold their value well and it’s not uncommon to be able to sell the car for more money a couple of years later.

When comparing this to leasing a car the savings are rediculous! The average savings of buying ANY second hand car is $4,856 per year for a two-car household.

That may not sound like a lot but wait for this…

If you invested $4,856 a year into an index fund that pays 7% on average for 20 years the final amount will blow… your… mind!!…

$277,455

Is leasing 2 cars compared to getting 2 second hand cars worth $277,455 to you? (btw if you carried on for 40 years it would be $1,890,496!!)

Do you still think leasing that brand new Audi is a good deal?

2. Want Stocks? Get Index Funds

This part of the book is more important than the air we breathe.

There are numerous reasons why Index funds are the best way to invest in the stock market but here are the main points summarised:

- The fees are so LOW in comparison to most funds that you can buy (this is why index funds win!)

- They consistently beat mutual funds even though they cannot beat the market (they track the market)

- They cannot go BUST, unlike mutual funds or individual companies!

- It saves so much TIME

- It

forces you to buy low and sell high (if you invest monthly or you rebalance your portfolio once a year) - If fund managers struggle to beat the market, what chance do you think you would have if you do it yourself

3. Start Young

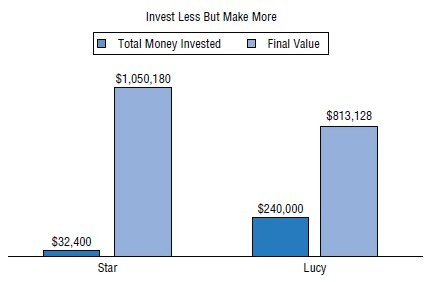

Let me tell you the story of Star and Lucy…

A 5 year old girl Star invested the $1.45 a day she earnt from recycling cans. She carried on investing $45 a month until she was 65 years old (a total of $32,400 invested).

Her friend Lucy, started to invest $800 a month at the age of 40 until she reached 65 (a total of $240,000).

Star’s final value was over $237,052 more than Lucy, despite Lucy investing WAY more money than Star.

QUOTE The best time to have started investing was when you were born. The second best time is today

Related Articles:

David Ramsey’s Complete Guid to Making Money- Is it Complete?

Rich Dad Poor Dad- Where it all Began

8 Lucrative Affiliate Marketing Tips for Beginners

But What About When the Market Crashes?

You’re smart enought to know it’s not if but when the market crashes.

This FACT blew my mind!…

Over the course of 2005-2015 the Vanguard S&P 500 Index averaged 8% per year... This was during the financial crisis of 2008-2009!!

Now, let me ask you a personal question. Do you think you could buy more stocks if the media and the whole world were panicking about the stock market and telling you it could cause a financial melt down?

I know I would find it hard!

This is the

Fear meant that investors stopped buying when the market was “on sale”

Now imagine you keep paying in the same amount every month. It means you buy MORE units when the prices are low and less units when they are HIGHER!

e.g. Let’s say you pay in $100 a month into a Vanguard Index Fund. If the price of the index fund is $10 you can buy 10 units. If it has crashed and is now $5 you can buy 20 units (it’s on SALE!!)

It is for this reason that the Vanguard Retirement 2045 Fund returned an average of 7.39% to their investors between 2005-2015 but the average investor who had a direct debit with them earnt 9.32%.

A return of over 9% a year on average DESPITE the crash of 2008-2009!!

So What Should I do?

Just picture this for a moment…

You never have to work again because your index funds provide you with MORE money than you need to live off.

To get to this stage we need to know some numbers.

Let’s imagine you and your family can live off $50,000 a year.

Let’s also assume your index fund returns an average of 7% per year.

Here’s the maths!…

Annual expenses/ Avg. return = Total nest pot to invest

$50,000/ 0.07 = $714,285.72

Just think about it… you can spend $50,000 a year forever, without touching the initial “nest pot”!

If you’re thinking that it will be IMPOSSIBLE to get a pot of $714,285.72 then read on…

Let’s just imagine you can save $20,000 a year and invest it in the stock market.

This would take you 17 years to reach your figure of $714,285.75 or 21 years to reach $1 million.

I will go more into detail about the unltimate strategy in a future post.

For now just know that the most important thing you can do it set up an account and GET STARTED! £100 a month will make a huge difference to your future.

Pin this to come back to this article again later.

My Final Opinion – Millionaire Teacher Book Review

If you are thinking to yourself “to be able to retire after 17 years is not bad” then you are right.

To be honest it’s much better advice than you will get from most financial advisors.

However, this is not allowing for inflation or any changes in your lifestyle (maybe you want to have children or your kids are going to uni or you want a holiday home to retire with etc.)

Plus you NEED to save $20,000 a year… EVERY year.

Andrew Hallam is clearly an extraordinary man.

He was able to be self-disciplined and did some things that most people would not be prepared to do.

Personally, I don’t believe in focussing too much on cutting expenses as it closes our minds and you will never be able to save more money than you earn.

The focus should always be on increasing our income!

Whilst Mr Hallam may have given himself a comfortable life and a financial indenpendence from his portfolio, he has only become “rich” by becoming an entreprenuer. He has missed out this fact in his book (just like Dave Ramsey).

He makes a lot of his income from books, courses and selling HIS products.

If you want to be “Financially Independent and Retire Early” (FIRE for short) you realistically need to find a side hustle or alternative ways of MAKING money.

Millionaire Teacher Book Review: The “MakeTimeOnline” Review Final Word

Now that you’re at the end of this millionaire teacher book review, you will have learnt the importance of investing in index funds and living frugally.

If you start early enough you can utilise compound interest to work for you, without having to put as much capital in yourself.

Let’s face the reality that index funds consistetly beat private investors and mutual funds due to:

- Fear & Greed (people tend to sell low/ buy high)

- Fees (mutual funds need to beat index funds by over 4% due to taxes, fees and commission costs

If you are looking to invest in the stock market this book will provide you with a guide as to how to start and the best index funds to use (if you live in the US, UK, Australia or Singapore).

Keep changing for the better,

Mike

p.s. If you have any questions and I mean ANY questions about Millionaire Teacher, please leave them below. If you have read this book before or something similar please add your thoughts.

p.p.s. If you are serious about making money online, I would advise you to check out my #1 recommended program here

As Albert Einstein said ‘Compounding interest is the 8th wonder of the world. He who understands it, earns it. He who doesn’t, pays it’.

Hi Andrea,

That literally sums it up!! Can I use this quote in the post please? I think it’s amazing!

Mike