Is this a complete guide? No is the short answer. The long answer is below.

In this review of Dave Ramsey’s book “Complete Guide to Money”, I am going to explain a bit about what the book is about. I will try my hardest not to completely destroy what Dave Ramsey has talked about as there definitely are a lot of good takeaways in the book.

Complete Guide to Money – The Overview and Rankings

- Name: Dave Ramsey’s Complete Guide to Money

- Author: Dave Ramsey – 1 out of 100

- Originality: 0 out of 100

- Practical methods: 30 out of 100

- Enjoyability: 0 out of 100

- Price: Kindle $9.30/ Hardcover $12.25

- Maketimeonline.com Rating: 7 out of 100

Pros and Cons

Pros

- Helps to create a financial plan for people

- Great budgeting advice- helps motivation to save money

- Some simple to follow steps to get out of debt- the snowball effect!

- The book has good negotiation tips

Cons

- Doesn’t practice what he preaches as this is not how Dave Ramsey has become “rich” (although he may have done this in the past to get out of debt)

- Too narrow in investment options

- Doesn’t encourage people to develop their own financial intelligence (or IQ)

- Uninspiring- The best case scenario you can hope for if you follow his advice is that you won’t have any debt and can be “better than average” when you retire… remember the “average American” is broke (his words not mine)

- He doesn’t understand what diversification really is

- He has poor financial IQ and people will listen to him- this is scary!

- He uses his religion to sell to people- He sells his courses at churches!!

- Unoriginal and no new financial advice

Let’s start with the Good

OK, Dave Ramsey sounds like a good person. I really would like to think he is trying to help other people and this is what motivates him to do what he does.

Financial Budgeting Advice

He provides some good solid advice about how to treat money. He explains some great baby steps to getting your life on track:

- put $1,000 aside for an emergency fund

- Pay off all debt using the debt snowball (pay off the smallest amount of debt first then the next smallest, instead of the debt with the highest interest- I liked this one as you will save money each time you pay off the debt and then you have more to pay off the next piece of debt, creating a snowball!)

- Put 3-6 months of expenses into savings as a full emergency fund

One of his best tips is to set a budget BEFORE each month so you already have an idea of what you want to spend money on. If you like eating out or going to the cinema, put this in your budget! You don’t have to stop enjoying the things you like doing but just allow for these things and put it in writing so you know what you are spending your money on.

Inflation

He talks about inflation in the book, which is crucial that people understand in today’s financial system. He explains how this is relevant for your investments. He mentions inflation is roughly 4% on average but with the fees you pay to mutual funds (the investment vehicle he recommends) you need to be hitting 6% interest to break even. However, inflation over the last few years has actually been more like 10% (read “how our wealth is being stolen” for more info)

Credit/ Debt

He explains how easy it is to get credit in this day and age and how bad it can be to buy “anything” (this is debatable in my eyes) with credit. His class were offered $7.9 million in credit in 13 weeks!! This is what holds most people back from getting anywhere as bad debt destroys wealth over time.

Negotiating

He has a chapter on how to find big bargains and talks about some negotiating tips (if you want a negotiation book, I’d highly recommend Chris Voss’- Never Split the Difference) Some of the tips he recommends, which are some great tips in any negotiation situation are:

- Always speak truthfully

- Use cash. You can take in the maximum amount you want to spend (don’t carry a card and don’t take any more!) Plus people psychologically see the cash and get excited so are more likely to take a lower offer.

- Be prepared to walk away. In today’s world, you can almost always buy or sell whatever it is somewhere else.

- Don’t talk too much. The more the other person talks the more likely they are to negotiate themselves down in price.

- Say “That’s not good enough!”– I haven’t tried this one but Chris Voss recommends “How could you help me?” I have found this works quite well as it gets the other person to think on your behalf so you don’t have to find the solution!

- Use “If I”- For example, “if I buy it for that much you’re going to have to throw in that sofa”. If they say they can’t then you say something like “well if you can give me the sofa you’re going to have to give me something else or come down in price”. You’ve added something else into the negotiation, which can help reduce the price!

Get Rich Quick Schemes

The only people that get rich from “get rich quick schemes” are the people selling them.

My definition of “rich” is having the money to be able to create freedom. Freedom to do what you choose each day. Freedom to buy the things you would like. Freedom to live the lifestyle you would like to.

Now I know Dave Ramsey is not selling a get rich quick scheme here, but he is still the only person getting “rich” from what he is selling! This links nicely onto the next heading…

Now some of the Bad

Best case you will be comfortable

The best case scenario from following his advice is that you will just have better control of your money and work until you’re 65, then have a “comfortable” retirement (this is relying on the mutual funds that you invest in to consistently provide a high return, the financial system never changing, there is no financial crash towards the end of your working career and a whole lot of good luck that is not in your control!)

If this something that you are happy with then that is wonderful! I hope you love your job and enjoy your holidays in Benidorm. However, if you want to be able to not have to work, or to travel the world, or make the world sustainable, or get humans onto Mars then you WILL NOT be able to do this by following Mr Ramsey’s advice.

Talking about how to get out of bad situations- Wasting Effort

The book has a tendency to talk too much about what to do in bad situations. For example, he gives a detailed 5 step plan of what to do if your identity has been compromised.

This has happened to us before and, believe me, if I had read this book it would have made no difference. We called the police who put us through to the fraud investigations team. We spoke to each company and they sorted it out for us.

Was this frustrating? Yes. Was it time-consuming? Yes. But in the end, we realised it wasn’t worth our time worrying about it. We could make a much bigger difference in our lives by focusing on how we were going to do to expand our means (at the time we were purchasing an investment property).

He doesn’t understand diversification

He talks a lot about being diversified with your investments. However, he doesn’t recommend any other investment other than paper assets (apart from property/ real estate when you can pay in cash!)

Therefore, he does not understand what it means to be diversified!

There are 4 main asset classes that we can invest in:

- Business

- Property/ Real Estate

- Commodities (Gold, Silver, Oil, Wheat, Water etc.)

- Paper Assets

He mentions 15 different investments throughout the book. 13 of them are paper assets i.e. stocks, bonds, mutual funds, retirement plans etc. He recommends mutual funds, which is actually financial suicide due to the high fees they charge (he even mentions the fees!)

I will literally save you the time of having to read Andrew Hallam’s book “The Millionaire Teacher” or Tony Robbin’s book “Unshakeable” or Ray Dalio’s book “Principles”. If you are wanting a safe way to invest in the long term, do not use mutual funds. Just find a good index fund with low fees and put your money in there (Vanguard is great, you can use nutmeg.com if you are in the UK).

Index funds beat all mutual funds over the long term as their fees are MUCH lower and they do pretty much the same thing (they are actually better because they use a larger market and rebalance your portfolio!) In case you haven’t heard of the guys above I would take their advice over Dave Ramsey’s any day (Sorry, I’m going off on a tangent here!)

How is Mr Ramsey actually rich?

Dave Ramsey has made his money by selling courses, books and financial advice. He is a business owner.

However, there are actually only 4 pages in the whole book where he mentions starting a side business!

And even in these few pages, he manages to pay some backhanded compliments to some people that did this and tried to advertise what they were doing through him…

This just so happens to lead onto what will be my favourite part of this post…

OK now for my real opinion 🙂

He looks down on these people who have started their own side business. He says (and I quote) “Our national ads are way too expensive for a company grossing $100,000 per year and we didn’t want to sink them” I literally spat out my drink when I read this!… How very charitable of you Mr Ramsey, it’s great to see you helping people improve their financial situations!

But don’t worry guys at least Dave is a stand-up guy. He sold them some “Internet-only ads at a bargain rate”!! Oh… My… You know what! (I don’t want to use blasphemy against a religious man)

Religion

This leads me onto how he sells his courses… His courses are advertised and promoted at Church!! He is using religion to help him sell courses for his benefit. Personally, I find that pretty disgusting. I know the Dave Ramsey fans out there will be saying “but he has helped me so much” and “now I have control of my finances”. The point I’m making is that there are loads of these personal finance guys out there and from what I can tell so far Dave Ramsey is not even a good one to listen to!

He may help you get ahead of the “Average American”. He says “normal” in America is broke, his words, not mine! Do you want to be just ahead of broke or do you want to actually live the life you want?

I find what he advocates is very un-aspirational and to be honest for most people doing this they will fail. His advice relies on years and years of willpower and self-discipline and faith that the people you hand your hard earned money to will give you the amazing returns they promise (and I guarantee they won’t be able to in the long run or you’ll pay the majority of the profits through fees!) You will at best just about keep your head above water and live a comfortable life!

Marketing

He talks about ways to guard yourself against marketing. He mentions how Sony use smells like vanilla and oranges to make you feel relaxed when walking in the store. In the swim section of big stores, they make it smell like sun cream so your mind can relate to holidays and puts you in a good mood.

He then goes on to say that in his own office, they bake cookies and put them in reception to make clients feel at ease. But in his case, this is just to give them a good experience… Obviously, it has nothing to do with trying to sell his courses!! Talk about hypocritical!!! He does the same thing that he’s telling you to put your guard up about.

Investing

His financial advice is sound up until baby step #3. After that, it may be easy to do but none of his advice will make anyone “rich”. It may get you out of debt and to allow you to live “comfortably” but 100% of the time it will not make you “rich”. You will never be able to quit your job when you’re young or live your dream lifestyle from following the advice in this book.

- 4. Invest 15% of your household income into retirement plans

- 5. Begin college funds for your kids

- 6. Pay off your home early

- 7. Build wealth and give

All of this advice involves so much reliance on your fund manager and does not improve your financial IQ at all. By the time you actually reach baby step number 7, you would be so old, there would be hardly any time left to build wealth or give anything!

Dave Ramsey has one piece of advice that he reiterates throughout the whole book: Avoid debt at all costs!

Now for the “average person” (a broke American remember), this is a great piece of advice. I completely agree that we should pay cash for our day to day expenses, we should have an emergency fund in a bank account and we should not waste money on things that are not needed.

However, Dave Ramsey doesn’t seem to understand good debt at all. He says “do not even think about investing in property until you can pay cash!”

Property

I can understand why some people may think this way and it’s clear that Dave Ramsey has been burnt from property investments in his past. However, there are so many ways to invest in property, let alone other asset classes. You can buy to rent out, you can refurbish and sell, you can refurb then remortgage and rent. You can invest in property without buying them such as rent to rent!

The one thing that I can guarantee is that it is riskier to just wait and not learn anything about investing until you can buy a property for cash!

The average UK house price in 2018 according to nationwide.co.uk is £216,103

The average salary for men according to Monster.com is £30,530 (it’s lower for women).

So let’s say, by some miracle, the average man manages to save £10,000 a year (a third of his salary each year despite tax, bills, accommodation and general living expenses). That means this average person will have to wait over 21 years to buy one investment property.

However, since 1952, the longest time it has taken for property prices to double has been 16 years. So it will more likely be over 40 years until this “average person” can even think about investing in property if they manage to save a third of their salary for 40 years!!

I’m no genius, but it is clear to see this person will NEVER invest in property and never even learn about ways of investing in property because they are waiting to save some made up amount of money before they start.

Commodities

Commodities are general things that humans need such as water, food, oil, metals etc. Dave doesn’t talk about any commodities to invest in other than gold. And all he says is don’t even consider investing in it!!

He claims that gold has only increased by 2.38% on average over the past 177 years.

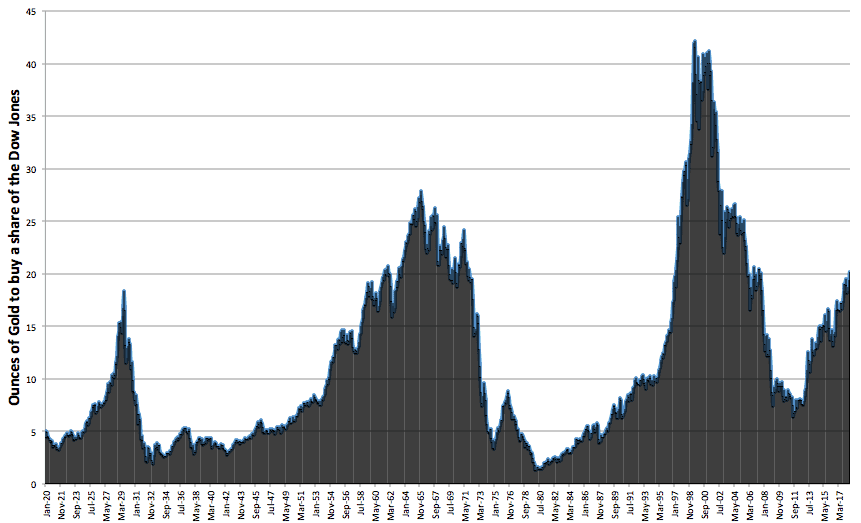

However, he fails to mention its current value in comparison to other assets. I don’t want to go into too much detail here as this will stray from the book review (again!) An example of working out value is by comparing how many ounces of gold it costs to purchase one share of the Dow Jones Industrial Average (DJI- 30 big American Stocks).

It currently would cost over 20 ounces of gold to purchase one share of the DJI. As seen in the graph above, there have only been 18 years (since 1920) that the price of gold was as undervalued as it currently is compared to the US stock market. Previously it has cost as low as 3 ounces of gold to buy one share.

This doesn’t mean everyone should now sell their stocks and buy gold. It just shows that with a good financial education you can start to make more informed decisions about what a good investment is and what isn’t!

This is just an example of ways to increase our own financial IQ. You can compare the value of gold to property prices, other precious metals, oil or pretty much anything. When you do this you will start to be able to understand whether something is overvalued or undervalued. The price of something should not be a factor when investing!

This is why it really baffled me and made me question whether this guy has any financial IQ when he said, “why would you want to buy something when it is at a 177 year high?”

EVERYTHING IS AT A 177 YEAR HIGH… because of inflation!! He even talked about inflation earlier in the book, he just doesn’t connect the two things!!

What can we do then?

Keep Learning

If there was one thing that you can take away from this review, it is to keep learning. Increase your financial IQ should be the main message from any financial book. Saving and sticking money into a mutual fund is a sure way to ensure you always stay average financially!

I’ve spoken highly about books like “The Millionaire Fastlane” and “Rich Dad Poor Dad“. I personally think finding your own “why” or defining your own vision, values and purpose is far more important than trying to pinch pennies.

Personally, from my own experience, it all becomes the same thing. When you end up working towards your goals and try to increase your income (or expand your means) you end up living below your means (spending less on “stuff”) because you spend your time more wisely.

Nearly all of our income now goes into investments, adventures abroad and experiences that make us happy with friends and family. We have stopped spending as much money on unnecessary purchases as we just don’t spend as much time shopping (I’ve always thought shopping is what bored people do!)

Pay Yourself First

We pay ourselves first and then spend the money left over. When I first heard Robert Kiyosaki say pay yourself first I completely misunderstood him. I thought that meant to go and buy the TV you want or the new pair of trainers that David Beckham wears.

What he really meant is put money away to buy assets first, and then use what’s left over for food, fun and bills. If you don’t have enough money for the month then you’re going to have to find a way to make more… or your bills won’t get paid and someone else will chase you up to make more money!

Expand your means

There are so many ways to make a little bit of extra cash if you need. Taking surveys online or becoming a virtual assistant (look into Fiverr or Upwork) are a couple (out of millions) of ways to make instant cash online. If you’re a teacher can you tutor? If you enjoy booking holidays, people will pay you to do this. I am one of these people who will pay you! Think about what you enjoy doing and start getting paid for this if you need more money towards the end of the month!

Long term it’s vital to find ways of increasing passive income. My definition of passive income is spending time today that pays you over and over again in the future. It doesn’t mean you won’t have to do anything again and money will keep rolling in. It just means money will keep rolling in even if you can’t work for one week, or you need to go on a holiday to Barbados for a month!!

This is exactly why starting an online business is a great way to expand your means. You will have to work on it to receive payments through affiliate links, adverts or selling your own products. However, once you do the work and set it up in a way to increase your traffic to the website for free (SEO) you can start to receive money over and over again for the time that you put in today.

The Complete Guide to Money: The “MakeTimeOnline” Review Final Word

This book has some great tips in if you are in a lot of bad debt and need some strategies to get your finances in order. You should set a monthly budget each month to get an idea of where your money is going. These tips are pretty simple, but very effective, ways of making your money work harder.

However, if you are looking for a COMPLETE guide to money. This book is not that.

The advice about investing actively discourages people to learn more about investments. The book encourages you to put your faith in mutual fund managers and pension schemes, which have already been proven to not know what they are doing when markets are going down (many mutual funds lost more than 40% in 2008!)

Truly sophisticated investors make money when markets are going up, down or sideways.

The truly “rich” make their money through business. Many people still have a belief that all business people are greedy and bad people. Or they believe they have some special, unique gift that we “mortals” don’t possess.

The truth is anyone can start a business… you can start one online in the next 5 minutes by clicking this link! Do you really want to have the freedom to choose what you want to do with your time and spend it with who you want to?

If you do, the only real focus should be figuring out “what is your why”. Keep spending time working out what your purpose, vision and values are. You will find the passion to do whatever you want from here.

The key takeaway from this review (not the book) is to keep increasing your own financial IQ!

Keep changing for the better,

Mike

If you have any questions and I mean ANY questions about the Complete Guide to Money, please leave them below. If you have read the book before or used any of Dave Ramsey’s courses before I’d love to hear from you too!!

If you are interested in making money online to free up your time, have a look at my #1 recommended program here, which I am currently using.

As my wife would say, “holy crap.” Your review, in my opinion, is completely off the charts. If I’m suppose to get to this level of writing to make a few bucks on line… I can see the headlines now, “poor blogger died of starvation.” By the time I learn to conduct a review at this level I will be 30 pounds and well on my way to successfully starving to death.

When I opened your page and saw the length I was taken back. I said to myself, sweet Jesus, do I have to read all that. But as I started I got caught up in what you were saying and I found myself not being able to look away. I’m almost feeling sorry for poor Mr. Ramsey.

I have great respect for excellent writing and excellent speeches. I salute YOU

Hi Ron,

Best comment I’ve ever had thank you!!

I do apologise for the length of the review but as you can probably tell I went off on a few tangents. It really frustrated me that a LOT of people will be taking this advice to heart and it’s leaving so many gaps to be filled in.

Have you ever read any of his work or similar books?

Thanks again for your comment.

Mike

Hi Mike, this article is full of the good and the bad, and it can also be a help to others being the fact that money is an important part our lives.

Dave.

Hi Dave,

Thanks for your comment. Money is important in today’s world, but it’s more important what money can do for our lives than actually having it.

For me, it’s all about creating more time and freedom to live the lifestyle we’d like.

Mike

Thanks for this honest review of Dave Ramsey’s book. I agree with most of what you have to say in your post. There are many things that he does that may seem hypocritical and I absolutely cannot stand his use of religion to push his products/program. Having said that, there is something to gain from his debt-free view. His snowball strategy has been used by many to pay off their debts in record time. I would say, use his first 3 steps until you are free of debt and discard the rest. He should not be your main resource for financial literacy and advice. He is good at one thing and that is killing off debt. As such, that should be his only role in your financial planning. Just my thoughts

Hi Mike,

You have literally summed up that lengthy review in your comment!!

I don’t think it could be more accurate. He really is good at giving advice to get out of bad debt.

But as I say I don’t actually think getting out of all debt is the best way to utilise the current financial system… Using debt that pays you more money each month than you have to pay for it is a crucial way to living a lifestyle that you want.

It’s just our education in this subject is typically not very good and people end up in a mess because of taking on too much debt (and nearly always bad debt)

The main types of good debt are rental properties and for business. As long as tenants pay for this debt I would like to get as much of this debt as possible…

Thanks for your comment

Mike

Beautiful site filled with great content and media. Who doesn’t want more money!

Hi Doc,

Thanks for your comment. It’s more about what money can do for our lives rather than wanting more money. Hence make TIME online!!

Hope you have a great day,

Mike

What books would you suggest

https://maketimeonline.com/best-self-improvement-books these ones