Most likely, you’re reading this article because someone spoke to you about an opportunity for you to make money at home, but you’ve wondered to yourself… is Financial Education Services a scam?

Well, to put you out of misery, I’m going to confirm that Financial Education Services is not a scam.

But you need to dig deeper into its earning opportunity for you to know if this is a legit opportunity to make money from home and is a suitable replacement for your full-time job.

This article will answer that question along with images, videos, and pros and cons, so that you can come up with an informed decision.

Financial Education Services Review

The overview and rankings

Name: Financial Education Services

Founder: Mike Toloff, Parimal Naik

Type: Financial Services MLM

Products (Including Pricing): 40/100

Success Stories: 26/100

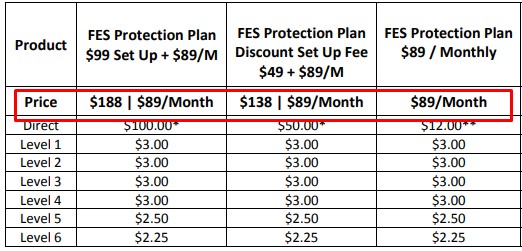

Price To Join MLM: $199 to $249 + $89 monthly

What to look for in a MLM:

Summary:

Financial Education Services is an MLM company that provides financial services such as credit cards, discount packages, and life insurance.

They also have an affiliate program where members can earn money by selling their services and products.

Make Time Online Rating: 30 out of 100

Recommended: No

What is Financial Education Services?

Financial Education Services is a Multi-Level-Marketing company that provides financial services in the form of discount packages, credit cards, and life insurance to name a few.

They also offer educational services to help clients learn how they can handle and manage their finances. Financial literacy is their focus, and they help their clients have that...

Mike Toloff and Parimal Naik founded the company in 2004, however it was still selling VR products back then.

Here is a 4-minute video about Financial Education Services you might want to check out...

They rebranded their company and started selling financial services in 2014 with the goal of helping clients achieve financial success by following professional tips that help them save money in the long term while securing assets in wise investments.

Is Financial Education Services a pyramid scheme?

Financial Education Services is not a pyramid scheme.

It’s because their members can still make some money by simply selling their services without recruiting people.

But a better and more accurate question to that is… Is Financial Education Services a pyramid scheme in disguise?

What is a pyramid scheme?

A company that is promising its members monetary payment for recruiting people into the company instead of having to sell the actual products and services offered.

A lot of governments have banned companies like this because it is impossible for everyone to earn money inside a company which only pays for recruitments.

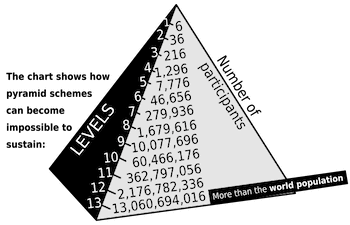

Check out this Wikipedia diagram to see why this happens...

The very few members who make money simply recruit people into the company by selling the idea of experiencing a business opportunity.

But if you were to base on the diagram, you can clearly see that it’s impossible for members to make some bucks inside a system such as this as you are surely going to run out of people to recruit.

Maybe you would like to check this 5-minute video that I recommend you to watch so you’ll know how to spot these pyramid schemes in disguise.

Now you know all these pyramid schemes, let's know why...

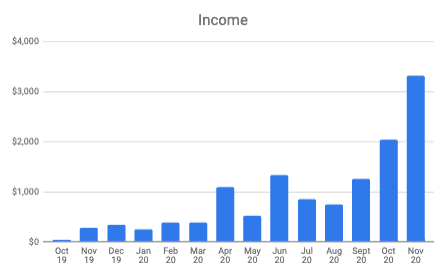

Success is rare with Financial Education Services

You are going to have a hard time achieving success in MLMs such as Financial Education Services.

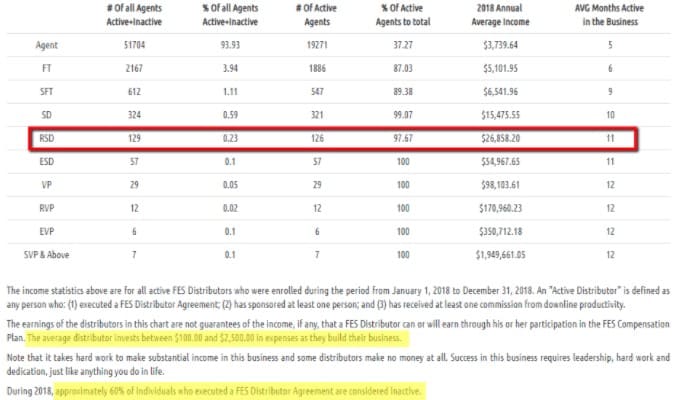

Did you know that 74.47% of Financial Education Services members lose money from the company?

And generally speaking, around 72.5% and 99.9% of all MLM representatives lose money as well.

This happens because MLMs have their own sales quota where members can only stay active and receive payment commissions if they are able to sell a specific number of products monthly.

If they can’t, then they have to buy the products themselves.

This is why the majority of the members lose thousands of dollars from their own pockets before they can land a single recruitment.

We’ll be focusing on the Financial Education Services income disclosure later...

How does Financial Education Services Work?

Financial Education Services sells financial services such as credit builder programs, asset investment seminars, travel plans, life insurance, and discount cards.

Aside from those, they also have an affiliate program where people can earn money by selling their products, and in the process, receiving commissions.

It looks like both sides win, but not until you know that the company saves millions of dollars because they don’t have to invest any money on their marketing campaign.

Why? Because they simply let their members do all the advertising! Before seeing if that’s really the case, let’s dig deeper into....

Financial Education Services products

If you are really interested in joining the company, then it’s vital that you know the products and services they are selling.

This way, you can have a higher chance of success because you know what you’re dealing with. However, I still recommend you try out the products yourself.

But if you can’t then, you can refer to this instead...

Financial Education Services provides finance-related products and services that come in the form of credit cards, investment guides, discount packages, and life insurance.

Specifically speaking, here are a few of their most popular products:

- My HealthCare2Go ($29 setup fee + $24.95/month) - A health life insurance that covers up to 6 immediate family members.

- Secure Card ($40/year) - A Mastercard credit card which is designed to help you manage shopping expenses. Its cost-efficient fees also help you improve your credit rating.

- MyCare Plan ($499) – A last will and trust plan package to safeguard your financial and physical assets.

- Rent Reporting ($25 to $145 depending on package + $6.95/month) – A report tool that manages your financial expenditure payment. It keeps track of your expenses and helps improve credit rating.

Take note, though, that there are many other MLM brands out there that offer the same services.

And it’s not just Financial Education Services! One of the most notable ones are:

Here's a 14-minute video overview about their offerings:

All of the other MLMs such as the latter claim they are special and that they offer very rare services even if what they’re actually offering are the same...

Can you make money with Financial Education Services?

You are going to have a hard time making money from Financial Education Services.

There might be a few people who earn some bucks, but they work very hard just to earn payment that’s just a bit higher than minimum wage.

Also, their income disclosure shows that there’s just very few people making commissions from Financial Education Services.

How to make money with Financial Education Services

There are 2 main ways you can make money from Financial Education Services. These are:

- Sell their offerings

- Recruit members

But take note that you can only earn money from the sales of your downlines, and not by simply recruiting them.

That’s a smart move for the company because this way, they are able to avoid being labeled as a pyramid scheme.

Nonetheless, I can say that they are a pyramid scheme in disguise because although they don’t earn from recruiting, their members still make money indirectly from their recruited members.

So the more members you recruit, the more money you can earn...

How much does it cost to join Financial Education Services?

You can join Financial Education Services by paying either $199 for the basic financial bliss package or $249 for the advanced financial bliss package.

I recommend you go for the second option. Aside from that you also have to sell $89 worth of products every month to stay as an active member.

Financial Education Services monthly cost

You must sell $89 worth of Financial Education Services products every month. This is equivalent to 89PV. If not, then you’ll be inactive and will be unable to receive commissions or make money.

The costs for the 1st year are..

- $199 - $249

- $89 x $12 = $1,068

Minimum costs for the 1st year = $1,267 - $1,317

And that’s before you add all the costs like training, marketing, gas, travel, and miscellaneous expenses...

Financial Education Services compensation plan

MLM companies usually make their own compensation plans confusing, and Financial Education Services is no different. But you don’t have to worry because I’ll do my best to explain it in the most straightforward way possible...

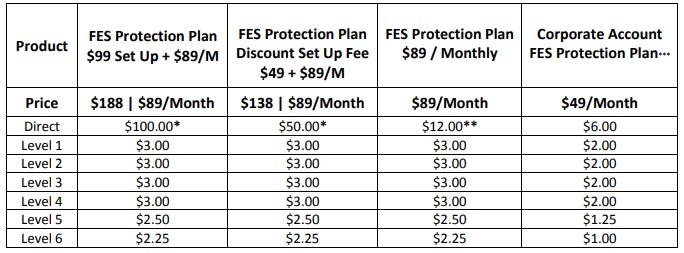

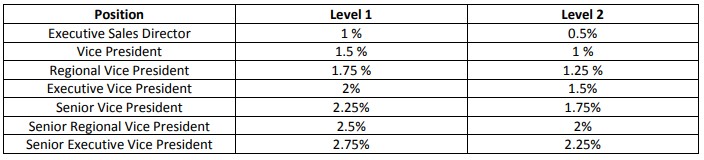

Send Out Cards offers you 3 main ways to earn money as a member:

- Direct Commissions - Earn $6 to $100 for every $49 and $188 worth of products sold respectively. You can also earn $40 to $150 for every $149 and $499 worth of product solid respectively.

- Customer Acquisition Bonus - Earn 25% to 50% commission for every sold product or service, depending on your rank.

- Generation Bonus - Earn 0.5% to 2.75% for every sale made based from your generational downlines.

Yes, I know. You’re still confused with all that.

Financial Education Services just like other MLMs are always using fancy terms and weird name to entice people into believing that there are lots of ways to make money from the company.

When the reality is… there are just 2 things to do!

- Sell Financial Education Services products

- Recruit people into Financial Education Services

Anyways, here is a 14-minute video you might want to get around with to have a better look at the compensation plan:

Or might as well check out the full Financial Education Services compensation plan here.

Is Financial Education Services a scam?

No. Financial Education Services is not a scam. The company sells legit products and they also pay members just like how much they say.

But the thing is… members are annoyed and disappointed to discover after a few months that they’re losing more money.

And they aren’t even making any bucks. For this reason, a lot of members and former members call the company a scam...

The next section of this review will help you see the solid facts about this company so you can come up with the right and informed decision if this is for you...

Common positive reviews

Here are some of the positive reviews we had from Indeed about the job opportunity...

- "You make your own schedule and can work from home which provides great flexibility especially if you are married and are a parent. Pay is commission only."

Common negative reviews

And here are the common negative reviews...

- "Its a commission only job and 70% of your day to day is needed to keep your rank. High Commission but high production and travel for trainings is encouraged."

Just to be fully transparent with you, I am not a distributor myself and I do not endorse it in any way.

I have researched the website, testimonials and information on the Internet to get to the bottom of what this program genuinely does. This is because I have been burnt from programs just like this in the past and I want to prevent others from making the same mistakes. If you’d like to learn how to “Spot an Online Marketing Scam” then click the highlighted text.

Tired of MLMs? Check out how I make money online here!

What I like about Financial Education Services

Here are some of the best things about Financial Education Services that will help you see the bright side...

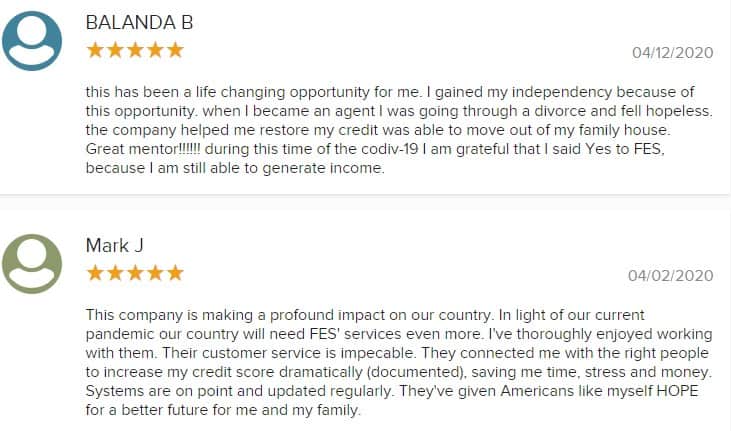

#1 Positive product reviews

One of the best things I like about Financial Education Services is that they’ve got a number of positive reviews about their products.

Here are some that I found in the internet:

As you can see, their offerings are helpful in one way or another. There are even a number of people who want to continue subscribing...

#2 Multiple offerings

Another thing I like most about this MLM is their many offerings. You have a lot of products to choose from, depending on what you want to improve yourself with.

Are you have a hard time managing your expenses? If so, then they’ve got a money savings tutorial. Or maybe you want to improve your bad credit rating? They’ve also got something for that.

But if they’ve got pros, they sure also have a load of cons...

What I don't like about Financial Education Services

And here are the not so good things about Financial Education services...

#1 Expensive subscription

Whenever I do a review, the first thing that I check is the subscription price. In this case, you have to pay $199 to $249 to become an official member. You then have to pay $89 monthly.

Paying $1,267 to $1,317 annually for membership is such a turnoff…

And it just doesn’t make any sense if what you’re looking for is a work-from-home opportunity.

#2 Hidden monthly expenses

Yes, you’ve just read that right.

Selling $89 worth of products monthly just to be an active member is what you’ll get here.

That is a huge turnoff for me because instead of reaping the many financial benefits you should gain from the company, you have to deal with the burden of having to sell these awful loads of “financial help” to as many people as you can.

Maintaining 89 PV monthly means you must sell $89 worth of Financial Education Services every single month. If you can’t, then you must buy them yourself.

That’s if you want to stay active!

The truth is… Financial Education Services’ biggest market is their members who just buy their stuff constantly because they are hoping to experience the “be your own boss” kind of lifestyle.

#3 Is Financial Education Services a pyramid scheme in disguise?

Knowing that you must spend $89 every month just to be an active member clearly shows that there’s something fishy going on here…

There’s only one way you can deal with that as well, and that’s by recruiting people to become your downlines.

Doing this means that you’re passing the burden or the “buck” to them.

You then motivate them to sell the company’s products to as many people as they can so that they can earn, and for you to benefit from their sales in the form of downline commissions.

#4 Only 1 in 588 members earn over $30k a year

If you’re going to check the Financial Education Services income disclosure, you can clearly see that 93.93% of all members are earning just $3,736 in a year.

Meanwhile, members have an average annual expense of $1,593.5 annually.

That is in no way profitable…

This also means that only 1 in 588 members earn more than $30,000 annually.

My opinion - Financial Education Services

No doubt that Financial Education Services offers interesting products that can help improve your financial standing with the help of their credit cards, insurance, and a host of financial assistance materials.

But when talking about their business opportunity?...

The only real way you can make money is if you recruit as many people as you can and force them to sell to stay active.

These people are just going to lose money in the long term…

For sure, this is a business model that you don’t want to be a part of...

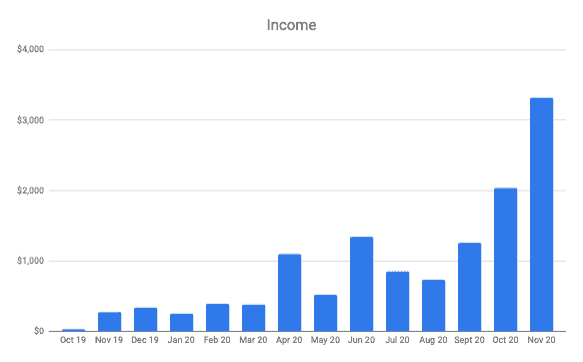

How I make passive income online

MLMs are not scams or illegal. However, I'm not a fan of them because of the restrictions to the expensive products you have to promote.

Once I learnt about affiliate marketing, I realised it's a far superior business model because:

- You can promote anything you want and truly own the business

- You never need to sell to friends and family

- It's completely free to start

In 2018 I had no idea what affiliate marketing was.

But I went from a full time PE teacher to making a passive income online within one year...

If you want to discover how I did it then check out this special video I created which explains exactly how. You can also get your free 7-day bootcamp to get started.

Thank you Mike,

You have definitely gone into a lot of detail regarding the Financial Education Services MLM and it definitely looks very difficult to make money especially if only 1 in 588 people earn over £30K. I think a lot of people would be very interested to find out this detail especially when it is actually costing quite a lot of money to be a member even with the two options. I always dislike the fact that you have to purchase or sell a minimum amount of goods which does always make it more difficult to make money.

I especially like to read about other online businesses to see if this is something that I would do and I am so pleased that I found Wealthy Affiliate with all the training that I have here. The other thing that I really like is the community of people who are more than happy to help you out if you get stuck or they can answer questions from their own expertise.

Thank you for putting this together.

Yep a lot of people are just unaware of these things before they jump in! I hope it can help

Hello dear, wow what an amazing post you have here I see you have written a very thorough article on the subject financial education review this has been one of the most thorough and laid down article I have read so far Your explicit expression your choice of words and skills of writing makes it easy for the readers to understand and form an opinion thanks my question is this does this website has any training program online

No problem, let me know if you have any questions about it

Hey nice article you have there, your thoughts are indeed invaluable. I have heard little about Financial education service from a friend. Having gone through this article, I have gotten a better perspective of its framework. Though it’s quite difficult to make money from this platform. However, I would love to know about the commission rate that is associated with recruiting a person to the platform

Glad it helped! Please check the compensation plan section again to learn this. You can earn 25-50% commissions

Great article mike. My sister was a victim of FES. From my own opinion… I think FES is is using credit repair as a bait to lure customers into the multi level marketing scheme where they have to bring in a number of new members all in the name of networking. A company that was sued $1.75 million for illegal credit repair activities in 2019 is not a company I want to trust. They always need new members so never run dry. Remember, new members and old members must keep up to the $88 monthly payment or they get kicked. They invest the funds gotten from the registration fees , invest in crypto or stock and payback. What they pay back is merely up to 3% of the total income keep in mind not everyone qualify for the paycheck from FES because the it’s really tasking. I was looking to use their credit repair service but I got to understand it’s a process I can actually do on my own. In the process I found a credit repair company called (spirassp) that totally changed my life taking my score from 520-780 in few months clearing out hard inquiries and it was mind blowing. They’re are still credit repair companies that hold you at heart out there.

Thanks for the insight John