Value investing is an investment strategy where investors search for stocks or assets that appear to be undervalued by the market to earn higher returns than other investments.

It requires careful consideration, given that the investor must anticipate and track company performance changes.

With value investing, patience is the ultimate virtue; it works best when investors only purchase securities that offer long-term value and hold those investments over time while monitoring their performance accordingly.

If you don’t know anything about value investing, you don’t have to worry. Nowadays, many online resources can help you understand any topic you want, including value investing.

One of these resources is the Value Investing and Fundamental Stock Analysis course by Kagwe Njoroge.

It’s an online investment course that promises to teach students everything they need about stock investing.

However, is this course legit, or is it a scam? Let’s find out.

Disclaimer:

This Value Investing and Fundamental Stock Analysis has been thoroughly researched with information and testimonials that are available online to anyone in the public. Any conclusions drawn by myself are opinions.

Value Investing and Fundamental Stock Analysis Review

The overview and rankings

Name: Value Investing and Fundamental Stock Analysis

Founder: Kagwe Njoroge

Type: Value Investment Course

Price: $84.99

Best for: Beginners in Value Investing

Summary:

The Value Investing and Fundamental Stock Analysis course claims to help beginners become a master at value investing and analyzing undervalued stocks. However, is it really what it claims to be? In this review, I am going to discuss everything you need to know about Kagwe Njoroge’s course.

Make Time Online Rating:

30 out of 100

Recommended: No

What is Value Investing and Fundamental Stock Analysis About?

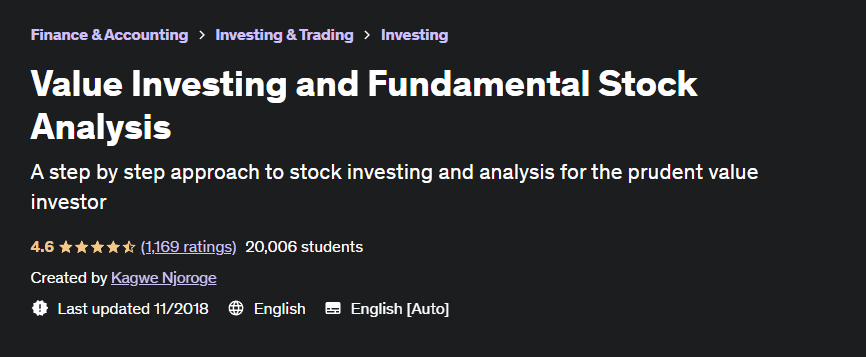

Value Investing and Fundamental Stock Analysis is an online course created by Kagwe Njoroge and offered on Udemy.

This course talks about the step-by-step approach to stock analysis and investing. According to the course, this training program will help you better understand stock analysis.

In addition, you will also learn how to apply, calculate, and define key investment ratios in choosing under-valued stocks.

One of the best things about this course is that it’s beginner-friendly. It does not require you to have prior knowledge about investing.

So, if you’re new to this topic, you’ll still find this course valuable.

Check out this 3-minute video to know more about this course...

Let us then know who started this all...

Who is Kagwe Njoroge?

Kagwe Njoroge is one of the instructors on Udemy. Today, he has one course offered on the platform with more than 20,000 students and more than 1,000 reviews.

Aside from being an instructor, Kagwe is also the director at Prosaic Invest. He’s also the CEO of a company called ChargeBound.

According to his profile, Kagwe started his investment career as a trader at Morgan Stanley’s Institutional Equities Division. Then, he also became a member of an investment team of Berkeley Energy.

As you can see, Kagwe is an experienced investor. Thus, it’s safe to say that he knows what he’s doing with his course.

How Does Value Investing and Fundamental Stock Analysis Work?

This course works the same way as the other courses you find on Udemy. The Value Investing and Fundamental Stock Analysis course contains videos you can watch in your free time.

In addition, Kagwe also included a couple of downloadable resources that you can use to improve your learning further.

Once you finish the course, you can also get a certificate of completion. You can use this certificate in your resume when applying for relevant jobs.

Inside Value Investing and Fundamental Stock Analysis

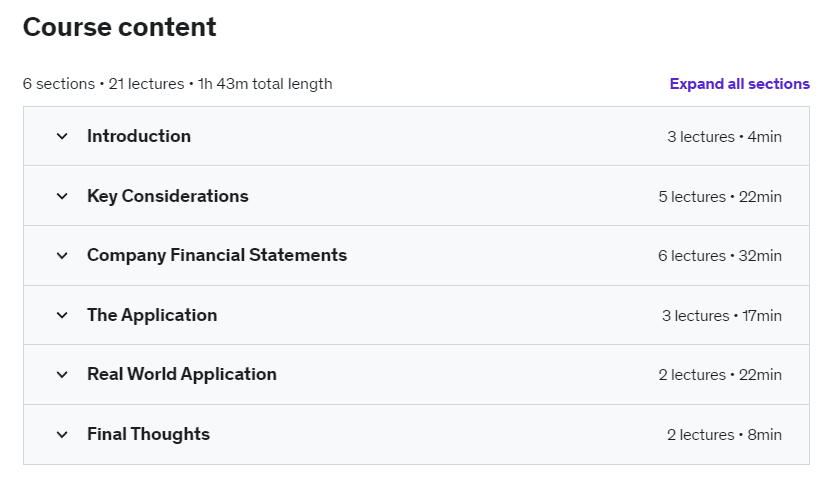

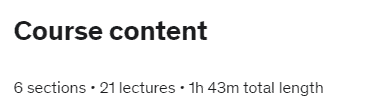

If you want to join this course, you probably want to know what’s inside it. Well, the course contains six modules and 21 lessons. You can finish the entire course within 1 hour and 43 minutes.

It’s pretty short compared to other investment courses. However, the lessons you get in this course are all concise. It’s brief but comprehensive.

Module 1: Introduction

The first module is called the introduction. As the title suggests, Kagwe will introduce you to this course and what to expect.

Aside from the introduction, Kagwe will also share with you the goals of the course and its structure.

The first module contains three lessons. You can finish this module in 4 minutes.

Module 2: Key Considerations

The second module of the course is titled “Key Considerations.” In this module, Kagwe will discuss why creating long-term investment portfolios is more significant today for all generations.

This module contains five lessons that you can finish in 22 minutes. Some lessons include the Pension Time Bomb, How to Invest in Stocks, Trading vs. Investing, and Value vs. Growth Investing.

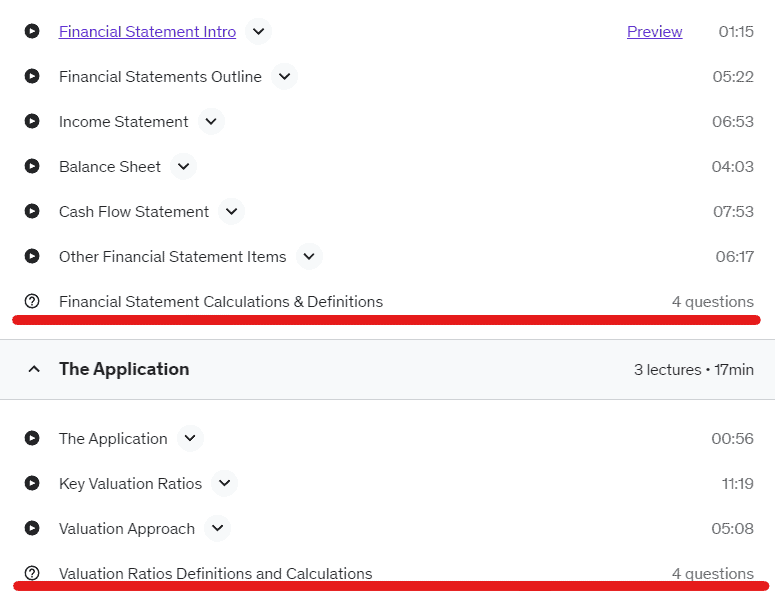

Module 3: Company Financial Statements

The course's third module contains six lessons you can finish in 32 minutes. In this module, Kagwe will teach you how to read and analyze a company's financial statement.

You will learn what to look for in a financial statement. This includes cash flow, balance sheet, income statement, and more.

Kagwe will discuss each of these statements. Thus, you mustn’t skip any of the lessons in this module.

At the end of this module, there will be a 4-question quiz about financial statement definitions and calculations.

Make sure you answer the quiz correctly before you proceed.

Module 4: The Application

The fourth module of the course is called the application. It contains three lessons that you can finish in 17 minutes.

In this module, Kagwe will teach you how to use the knowledge you’ve acquired in the previous modules to identify undervalued stocks in real life.

In this module, you will also learn about Key Valuation Ratios and Valuation Approach.

There’s also a quiz at the end of this module. The quiz is about Valuation Calculations and Definitions. Make sure you complete the quiz before you proceed.

Module 5: Real-World Application

The fifth module of the course is called Real World Application. It contains two lessons that you can finish in 22 minutes.

In this module, Kagwe will briefly summarize everything he has covered in the previous modules and bring them together to carry out an example case study.

In addition, you will also have to analyze the case study on your own using the methods you’ve learned in the previous modules.

Next, Kagwe will also help you perform a valuation analysis on an example company from beginning to end. He will include the steps covered in the previous modules.

Module 6: Final Thoughts

This is the last module of the course, and it is the conclusion. This module contains two lessons that you can finish in 8 minutes.

In this module, Kagwe will discuss the theory of diversification. In addition, he will also share with you a couple of valuable tips from the Sage of Omaha’s approach.

Furthermore, Kagwe will also teach you a few key reflections you need to become a better investor.

Check out this 2-minute video that gives you a glimpse on this course...

How to Join Value Investing and Fundamental Stock Analysis

One of the best things about this course is that it’s pretty easy to join. This is because you can buy the course on Udemy. If you want to join, you simply need to follow these steps:

First, visit Udemy.com. Once you’re on the homepage of Udemy, click on the big search bar at the top of the page and type in Value Investing and Fundamental Stock Analysis. Then, click enter.

After clicking enter, it should direct you to the results page of Udemy. You’ll find a couple of results. However, the first result should be the one you’re looking for. It should have the same title as your query.

Click that course to visit its page. Once you’re on the course’s page, you’ll find a “Buy Now” button on the right side. Click that button. Next, type in your payment details, and you’re ready.

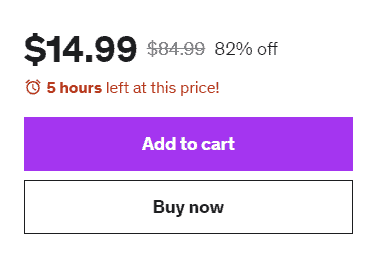

Value Investing and Fundamental Stock Analysis Cost to Join

The cost to join this course is $84.99. However, Udemy is offering an 82% off deal today. Thus, the current price as of this writing is only $14.99.

Value Investing and Fundamental Stock Analysis Reviews Online

The Value Investing and Fundamental Stock Analysis is an investing course that teaches you all there is to know about Investing and how you can use it to and earn money in the future through stocks.

But is it any good?

The only way to know this is to read reviews from people who have tried it by themselves...

Common Positive Value Investing and Fundamental Stock Analysis Reviews

- Many usable contents

- Anyone with zero knowledge of finance can understand it.

- Well thought out and well-paced.

The following comments below are the common positive reviews you’ll find online:

- “Really helpful for beginner investors. I usually find other free courses as introductions, but this has many usable contents. Also, appreciate that it has a real-world application. :)”

- “Excellent course. I have been interested in personal finance for the past few years and have attended many courses and video tutorials and talked to people. However, I learned many new ideas and ratios that I had overlooked. This course and the tools are beneficial to me. Thank you so much for sharing the course. Excellent communication in simple language so anyone with zero knowledge of finance can also understand it. A gem!!!”

- “Fantastic course. Well thought out and well-paced. As a novice to this, it gave me all the information I needed clearly and concisely. It may have stopped me from making bad investment decisions and consequently losing money. The additional resources are a great bonus.”

Common Negative Value Investing and Fundamental Stock Analysis Reviews

- Can put more effort into improving the course.

- Didn't get the certificate of completion.

- Need to show more examples.

And here are the best negative reviews I seen:

- “I think this guy can put more effort into improving the course. It is ideal for somebody that is not aware of financial markets. So globally, the course is worth doing.”

- “I didn't get the certificate of completion as it was given in the course when I started. This is a fraud. I want my certificate as soon as possible.”

- “Well, the information provided is good, but it would be better if the instructor showed more examples to understand the information better. There is not much theoretical knowledge nor many practical ways to find bargain companies.”

Is Value Investing and Fundamental Stock Analysis a Scam?

The answer is no. This course is not a scam. It’s a legit course from a legitimate individual. Once you pay the enrollment fee, you will immediately get access to all of its content.

In addition, Udemy doesn’t allow scammers to sell courses on their platform. Thus, it’s safe to say that this course is not a scam.

Tired of MLMs? Check out how I make money online here!

Value Investing and Fundamental Stock Analysis Pros

Here are some of the best things that I discovered when reviewing The Value Investing and Fundamental Stock Analysis...

#1 Instructor is knowledgeable

Kagwe is an experienced and knowledgeable person when it comes to investing. His Udemy profile shows he has experience trading and investing in well-known companies.

In addition, he currently has more than 20,000 students enrolled in his course and has a 4.6 instructor rating on Udemy.

#2 Quizzes to test your knowledge

Another great thing about this course is that some modules include a quiz at the end. This will help you test your knowledge to see how much you’ve learned from the lessons.

If you fail the quiz, you can review the lessons. You should only proceed when you pass the test.

#3 Beginner-friendly

This course does not have any prerequisites. So, if you have zero investment knowledge, you can still enroll in this course.

Value Investing and Fundamental Stock Analysis Cons

And here are some of the things I find off in TValue Investing and Fundamental Stock Analysis... So take note of these...

#1 Confusing

Even though this course is beginner-friendly, some newbies might find some words confusing. This is because the instructor often uses business terms without explaining their meanings.

#2 Bit too short

Note that you’ll be paying $84.99 for a course you can finish in 1 hour and 43 minutes. It’s simply too short for that price.

The truth is that you can find most of the lessons for free on YouTube.

#3 It is not updated

According to the course’s page, the last update was in November 2018. As of today, it’s four years without any updates. So, you can guarantee that some of the information is outdated.

My Opinion - Value Investing and Fundamental Stock Analysis

So, is Value Investing and Fundamental Stock Analysis worth it? In my opinion, the answer is no. It’s just too expensive for a short course.

Paying $84.99 for a 1.5-hour course is not worth the money. This is particularly true since there are a lot of more comprehensive courses that you can buy for the same price or even cheaper.

How I make passive income online

In 2018 I had no idea what affiliate marketing was.

Once I learnt about it, it just seemed like a great business model that can grow over time using the power of the internet.

So I tried to figure it out by myself... that got me nowhere fast.

Then I fell for some terrible online scams.

But eventually, I found Wealthy Affiliate. It teaches long-term proven strategies to build an online business with all the tools & support needed.

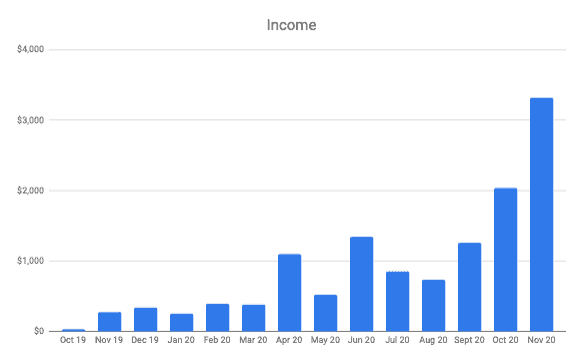

And this happened...

Once you learn the process of getting thousands of people to find your website every month (for free) there really is not limit to what you can achieve online.

I've reviewed hundreds of courses or programs that claim to help people make money online. And I've spoken to dozens of 6-7 figure online entrepreneurs on my podcast.

This is by far the best place I've seen to help beginners get set up on the right foot. You can read my full Wealthy Affiliate review here (including the pros and cons!)

Or you can watch an insiders video I made that explains exactly how it works here.