There are many things that investors look at when deciding whether or not to invest in a stock.

P/E ratios, price-to-book ratios, and dividend yields play a role in an investor's decision-making process.

But what about undervalued stocks? What exactly are they, and how can an investor find them? Well, this is where the Undervalued Stocks Investing course comes in.

This course claims to teach people how to find undervalued stocks and profit from them. However, is it legit, or is it a scam? Is it worth your money at all?

Disclaimer:

This Undervalued Stocks Investing review has been thoroughly researched with information and testimonials that are available online to anyone in the public. Any conclusions drawn by myself are opinions.

Undervalued Stocks Investing Review

The overview and rankings

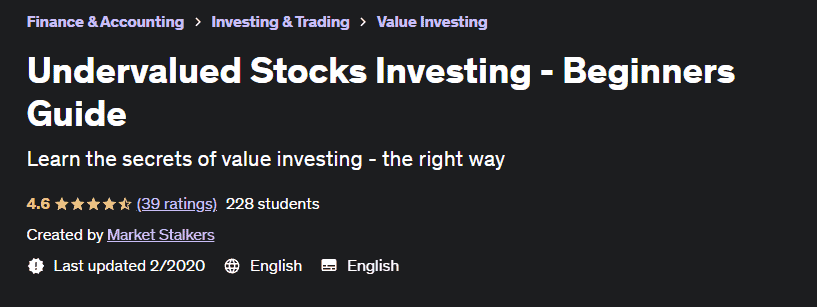

Name: Undervalued Stocks Investing

Founder: Deeyana Angelo

Type: Stocks Investment Course

Price: $29.99

Best for: Beginners in stocks investing

Summary:

If you want to learn more about undervalued stocks, you’re probably considering enrolling in this course. However, is Undervalued Stocks Investing worth your money? Let’s find out

Make Time Online Rating:

40 out of 100

Recommended: No

What is Undervalued Stocks Investing about?

Undervalued Stocks Investing is an online course offered at Udemy. Unlike other stock investment courses, this course focuses on undervalued stocks.

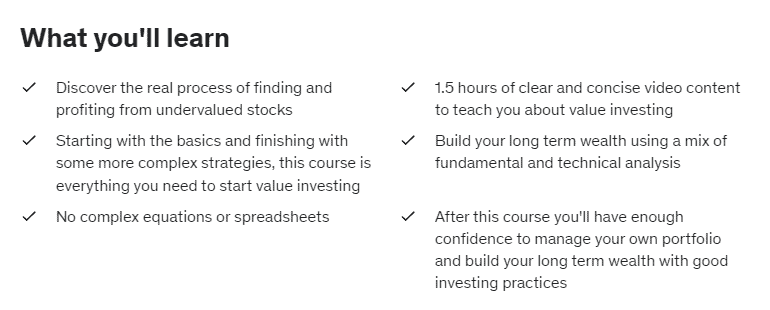

In this course, you will learn the process of profiting and finding undervalued stocks on the market. It will also teach you the basics and complex investment strategies.

This course also claims that once you’re done, you will have the skills and knowledge to build your long-term wealth and manage your portfolio.

Note that this course is only 1.5 hours long. So, the promise of getting the skills and knowledge required to be a master at investing is quite a stretch.

Check out this 8-minute video to know more about this course...

Let us then know who started this all...

Who is Deeyana Angelo?

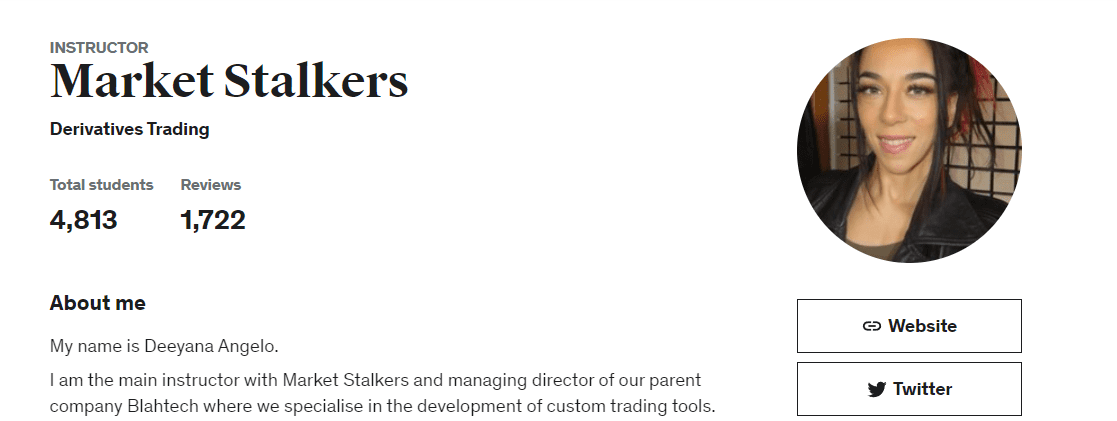

Deeyana Angelo is the creator and instructor of the Undervalued Stocks Investing course.

She’s also the managing director of Blahtech, a company specializing in developing custom trading tools.

Before she started her career in trading and investing, Deeyana was a musician. However, nowadays, she has a huge passion for trading the markets and teaching other people strategies and tricks that she has learned.

According to Deeyana, she has more than 14 years of experience in the industry. She also holds a Level 4 Investment Advisor qualification. It’s identical to Series 3/7 in the United States.

According to her Udemy profile, Deeyana has a 4.5 instructor rating. In addition, she also offers four courses on the platform and has more than 4,813 students currently enrolled.

How does Undervalued Stocks Investing Work?

Like any course you find on Udemy, Undervalued Stocks Investing is divided into several modules. Then, each module is divided into a couple of lessons.

This course contains around 1.5 hours’ worth of videos. Thus, it is pretty short. However, according to the course’s page, this is a concise but legit course to properly introduce people to the stock market.

In addition, you’ll also get a certificate of completion when you finish this course.

Unlike other online investing courses, this course focuses on Value Investing. It will teach students about value investing through Deeyana’s systematic process.

For those who don’t know, value investing is a low-risk strategy many successful investors use.

Inside Undervalued Stocks Investing

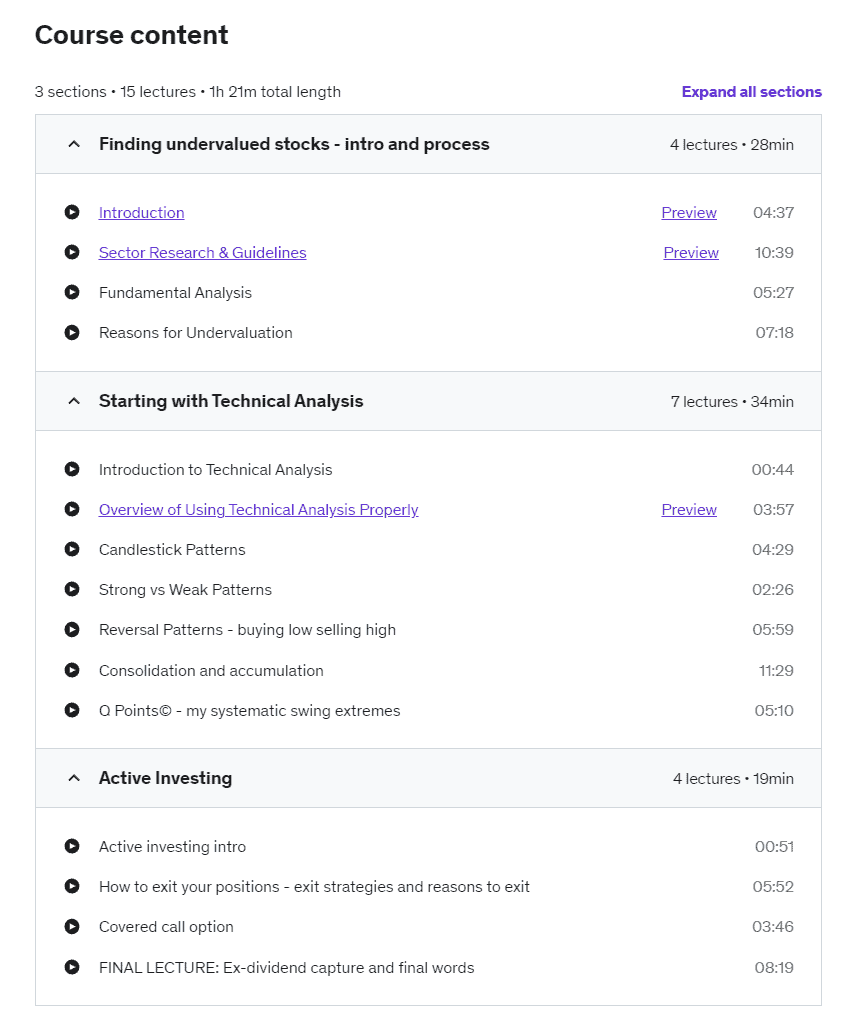

As mentioned earlier, the Undervalued Stocks Investing course has 1.5 hours’ worth of videos. Thus, you can finish it in a day.

In addition, the course is divided into three modules. Each module contains different lessons in a video format. Thus, all you’ve got to do is to take notes and learn.

Module 1: Finding Undervalued Stocks – Intro and Process

The first module of the course is titled “Finding Undervalued Stocks – Intro and Process.” As the name suggests, this module will teach you to find undervalued stocks. It contains four lessons.

The first lesson in this module is the introduction. It’s a 5-minute video introducing you to the course and the lessons.

The second module is called “Sector Research and Guidelines.” It’s an 11-minute video that will teach you how to choose your specialty.

The third lesson is called “Fundamental Analysis.” It’s a 6-minute video that will teach you more about fundamental analysis.

The fourth lesson is called “Reasons for Undervaluation.” In this lesson, you will learn why you should consider undervalued stocks. It’s an 8-minute video.

Module 2: Starting with Technical Analysis

The course's second module is titled “Starting with Technical Analysis.” You will need at least 34 minutes to finish this module, containing seven lessons.

The first lesson is simply an introduction. You can skip this if you want.

The second lesson is an overview of how to use technical analysis properly. Deeyana will teach you how to use technical analysis correctly in this lesson. It’s a 4-minute video.

The third lesson is called “Candlestick Patterns.” It’s a 5-minute video that will teach you more about candlestick patterns.

The fourth lesson is called “Strong vs. Weak Patterns.” In this lesson, Deeyana will explain the difference between strong and weak patterns and how to determine each.

The fifth lesson is called “Reversal Patterns – Buying Low Selling High.” It’s a 6-minute video that will teach you how to use reversal patterns in your investment strategy.

The sixth lesson is called “Accumulation and Consolidation.” It’s a 12-minute video.

The seventh lesson is called “Q-Points.” Deeyana will teach you her systematic process regarding swing extremes in this lesson. It’s a 6-minute video.

Module 3: Active Investing

The third and final module of the course is called Active Investing. It contains four lessons; you will need at least 19 minutes to finish them.

The first lesson is another introduction. As usual, you can skip this if you want.

The second lesson is titled “How to Exit Your Positions – Exit Strategies and Reasons to Exit.” In this lesson, you will learn when and why you should exit your position and how to do it correctly.

The third lesson is “Covered Call Option.” It’s a 4-minute video that will teach you more about covered calls.

The final lesson is called “Final Lesson – Ex-dividend Capture.” This is the last lesson of the course. It will teach you more about ex-dividend. In addition, Deeyana will also share a couple of final words.

So, technically, module 2 only contains four lessons.

Check out this 10-minute video that gives you a glimpse on this course...

How to Join Undervalued Stocks Investing

Fortunately, joining this course is relatively easy since you can purchase it on Udemy. Udemy is one of the best online learning platforms for those who don't know.

First, you need to visit Udemy’s website, which is Udemy.com. Once on the homepage, type in “Undervalued Stocks Investing” on the search bar and hit enter.

Then, it should direct you to the results page. The first result should be the correct course. The title should be “Undervalued Stocks Investing – Beginners Guide.” Click that link.

Once you’re on the course's main page, click the “Buy Now” button on the right. Then, fill in your personal information and payment details, and you’re good to go.

Undervalued Stocks Investing Cost to Join

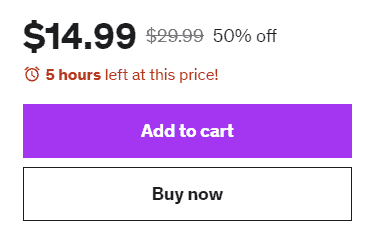

The cost to join Undervalued Stocks Investing is $29.99. However, Udemy is offering 50% off the price today, making it only $14.99.

This is one of the benefits of Udemy. They regularly offer discounts on their courses. If you notice that this course isn’t discounted, try to come back later.

In addition, Udemy offers discounts for a limited time. Usually, promos only last for a couple of hours. So, when you see one, ensure you get it immediately.

Undervalued Stocks Investing reviews online

Undervalued Stocks Investing is an investing course that teaches you all there is to know about Investing and how you can use it to and earn money in the future through stocks.

But is it any good?

The only way to know this is to read reviews from people who have tried it by themselves...

Common Positive Undervalued Stocks Investing reviews

- Easy to understand

- Clear to the point

- Inspiring course

The following comments below are the common positive reviews you’ll find online:

- “Deeyana made it easy to understand the basics of stock trading. Of course, there is always much more to learn, but she explained stock trading basics.”

- “This lecture is very clear and to the point. I am a novice trader looking to expand my skills, and this lecture has helped me to do so. Thank You”

- “Very inspiring course. I can't wait to listen to her other courses. I find her teaching clear and to the point of relevance.”

Common Negative Undervalued Stocks Investing reviews

- The page displayed a false description

- The topics seemed more random

- It felt a little at a loss

And here are the best negative reviews I seen:

- “This course explains little about fundamental investing and is more for swing traders. The page displayed a false description, and I tried for a refund but had watched too much of the content to get one...Don't waste your time and money like I have if you want to learn about an entire company investing.”

- “The first half of the course was good. The topics that she covered were related to each other. In the second half of the course, the topics seemed more random. There is no way that you can take these lessons and get started trading. I can't get a set of topics for which to do research. You get the feeling like she knows what she's talking about, but you also get the feeling that you have to buy more classes to make sense of it all.”

- “I have decided to give this a relatively low rating because I have already taken two of your other courses, and they were both most excellent, five stars each. With this one, I felt a little at a loss because it delves into some important concepts but at a rather superficial level and appears rather disjunct. Each of the three main sections could be an hour-long lecture. I found this course to be hopscotch of a variety of things, none of which were covered deeply. Expanding on any of the three and diving deeper into more sophisticated concepts rather than just saying look at the PEG alone would have contributed to not making the course appear quite as disjunct.”

Is Undervalued Stocks Investing a scam?

The Undervalued Stocks Investing Course is not a Scam. It's a legit course.

First, it focuses on undervalued stocks, which means there is room for growth potential. Second, the instructor is an experienced investor who has succeeded in both bull and bear markets.

Finally, the course is broken down into easy-to-follow modules so you can learn at your own pace.

Tired of MLMs? Check out how I make money online here!

Undervalued Stocks Investing Pros

Here are some of the best things that I discovered when reviewing Undervalued Stocks Investing...

#1 It is cheap

Paying $29.99 for a course that will teach you how to become profitable with undervalued stocks is relatively cheap. In addition, you can also get this course for a discounted price.

If you’re lucky enough, you can get 80% off. This makes the price a lot cheaper.

#2 You'll learn a lot

Another advantage of this course is that you will learn much when you finish it. Most investment courses will often leave you hanging. They do this so you will purchase their next course.

However, that isn’t the case with Undervalued Stocks Investing. Once you’re done, you can start your investing journey and simply learn from your experience. It will be up to you to buy an advanced course.

#3 It's Good for Beginners

If you’re a beginner in investing, this course is for you. It’s specifically designed with beginners in mind. This means that all the information and words used in the course are easy to understand.

Undervalued Stocks Investing Cons

And here are some of the things I find off in Undervalued Stocks Investing... So take note of these...

#1 There are better courses out there

If you want to learn more about undervalued stocks, one thing to note is that there are better courses. This course's only advantage over the others is that it’s cheaper and shorter.

#2 It's quite old

This course is quite old. According to its page, the course was last updated on February 2020. Thus, there’s a possibility that some of its details are outdated.

#3 Little review and low students

Today, the course only has 228 students enrolled and 39 ratings. This is relatively low compared to other investment courses on Udemy.

My opinion - Undervalued Stocks Investing

After researching, I found that it is a legit course with real value.

If you're interested in learning more about investing in undervalued stocks, I recommend checking out the Undervalued Stocks Investing Course.

It could be just what you need to jumpstart your investing career!

However, note that there are other better courses out there. So, you should also research to find the ideal course for your needs.

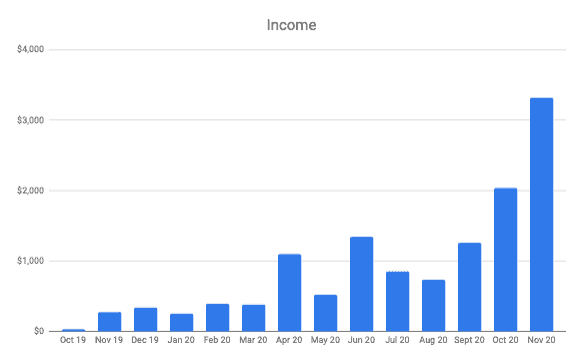

How I make passive income online

In 2018 I had no idea what affiliate marketing was.

Once I learnt about it, it just seemed like a great business model that can grow over time using the power of the internet.

So I tried to figure it out by myself... that got me nowhere fast.

Then I fell for some terrible online scams.

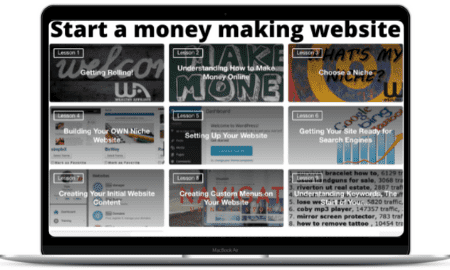

But eventually, I found Wealthy Affiliate. It teaches long-term proven strategies to build an online business with all the tools & support needed.

And this happened...

Once you learn the process of getting thousands of people to find your website every month (for free) there really is not limit to what you can achieve online.

I've reviewed hundreds of courses or programs that claim to help people make money online. And I've spoken to dozens of 6-7 figure online entrepreneurs on my podcast.

This is by far the best place I've seen to help beginners get set up on the right foot. You can read my full Wealthy Affiliate review here (including the pros and cons!)

Or you can watch an insiders video I made that explains exactly how it works here.