Analyzing stocks can be extremely time-consuming. However, for people who do it, there is typically a passion associated with the process.

Though it would be nice to have a couple of individuals on your side helping you analyze stocks, that is just not practical for an individual investor.

This is particularly true if you’re new to investing. As a beginner, you are probably looking to get yourself educated first. So, where can you find the education that you need?

One option you can consider is Morningstar.

But what is Morningstar? Who founded it? Will it help you become an expert investor? Let’s find out.

Disclaimer:

This Morningstar review has been thoroughly researched with information and testimonials that are available online to anyone in the public. Any conclusions drawn by myself are opinions.

Morningstar Review

The overview and rankings

Name: Morningstar

Founder: Joseph Mansueto

Type: Investment Course

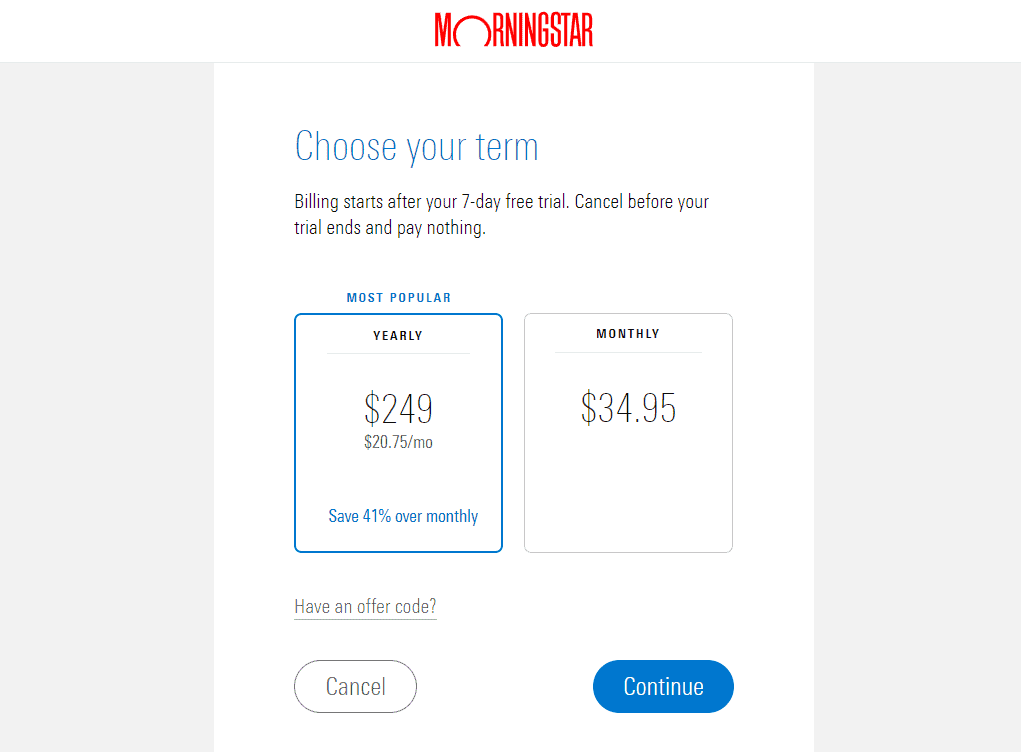

Price: $34.95 per month or $249 per year

Best for: Beginners in Investing

Summary:

If you’re looking to learn more about investing in stocks, mutual funds, and ETFs, you have probably heard of Morningstar. In this review, we’re going to learn more about this platform and whether or not it’s the best fit for you.

Make Time Online Rating:

35 out of 100

Recommended: No

What is Morningstar about?

If you’re trying to learn more about investing, you probably have heard of Morningstar. This company is well-known for offering ratings on mutual funds that are heavily relied on and widely respected throughout the industry.

Morningstar is an investment research company. It was founded in 1984 and is based in Chicago. According to experts, Morningstar is one of the most influential companies in investing.

It offers ratings, tools, and other information to help investors make more informed decisions.

Check out this 3-minute video to know more about this course...

Let us then know who started this all...

Who is Joseph Mansueto?

Joseph Daniel Mansueto is an American billionaire entrepreneur. He was born on September 3, 1956. He’s also the executive chairman, majority owner, and founder of Morningstar.

In addition to that, Joseph is also the owner of Chicago Fire FC, a Major League Soccer club.

Joseph founded Morningstar in 1984 out of his home. During this time, Joseph only had $80,000 as the capital for his business. In May 2005, Morningstar went public.

How does Morningstar Work?

Morningstar offers ratings and analysis of individual securities. This includes ETFs, bonds, and stocks. However, it primarily focuses on mutual funds.

The service will mainly benefit buy-and-hold and long-term investors. This is particularly true if they prefer investing with mutual funds.

Morningstar also offers a subscription service called Morningstar Investor. This will offer investors access to full details on different types of investments.

Also, it will offer ratings on mutual funds to help you choose the ones that will work best in your portfolio.

Inside Morningstar

According to Morningstar, they view investment ideas as simply a single part of the financial picture of an investor. Because of this, they provide resources such as portfolio optimization tools that can help investors make their lives easier.

Once you sign up for Morningstar Premium, you’ll get access to its portfolio tools, fund screeners, proprietary rating data, objective analyst reports, and top investment picks.

Educational Resources

Morningstar offers worksheets to help with your complete financial picture. These worksheets include a net worth worksheet, goal planning worksheet, budget worksheet, and more.

In addition to that, they also offer the “Morningstar Investing Classroom”. It’s a self-study educational platform that will teach you more about investing.

Article Archive

Morningstar subscription service provides a range of planning tools. This includes saving for college, retirement savings, personal finance, and tax planning.

Within each of these topics, Morningstar hosts a variety of educational articles that can help you with your planning process.

Screeners

While it also provides screeners for ETFs and stocks, the “Basic Fund Screener” is a special tool that allows people to filter mutual funds by category, rating, or performance.

With this, people can easily determine funds that best fit their style of investing.

Similar Funds

One of the most successful approaches to lowering your capital gains tax is through Tax loss harvesting.

The Similar Funds feature of Morningstar helps people look for mutual funds that are the same as their target funds. This enables them to easily look for replacement funds and lower their yearly taxes.

For many investors, this tool alone easily pays for the cost of the subscription service.

Portfolio X-ray

After you have set up your portfolio in Morningstar, this tool assesses your asset allocation and investment mix to reveal any underweight areas or concentrated positions.

A lot of investors spend a huge amount of money on financial advisors to get insights like this. However, you can get this if you simply subscribe to Morningstar’s subscription service.

Portfolio Manager

This tool provides you the opportunity to monitor your investments, create watchlists of possible opportunities, assess your portfolio strategy, and much more.

This is also the reason why a lot of professional investors rank Morningstar as the best stock portfolio tracker online.

Fund Analysis and Best Investments

If you’re an investor, you are probably always looking for the best investment opportunities out there.

Luckily, Morningstar can help you if you’re having a hard time looking for the best starter funds, target-date funds, index funds, bond funds, bonds, ETFs, stocks, and funds.

The Best Investments section compiles the best investment ideas from the independent analysts of Morningstar.

This enables people to sort by categories such as Portfolio Builders, Undervalued, Income and Retirement, Type, and Featured.

Analyst Reports

Morningstar is one of the investment platforms online that offers in-depth, data-driven, and objective reports and analyses on a certain investment.

Every report that you find in Morningstar is extremely thorough and comprehensive. The Full Analysis of Morningstar will offer you every single thing about the company’s condition and where it’s likely to go down the line.

Check out this 2-minute and 30 second video that gives you a glimpse on this course...

How to Join Morningstar?

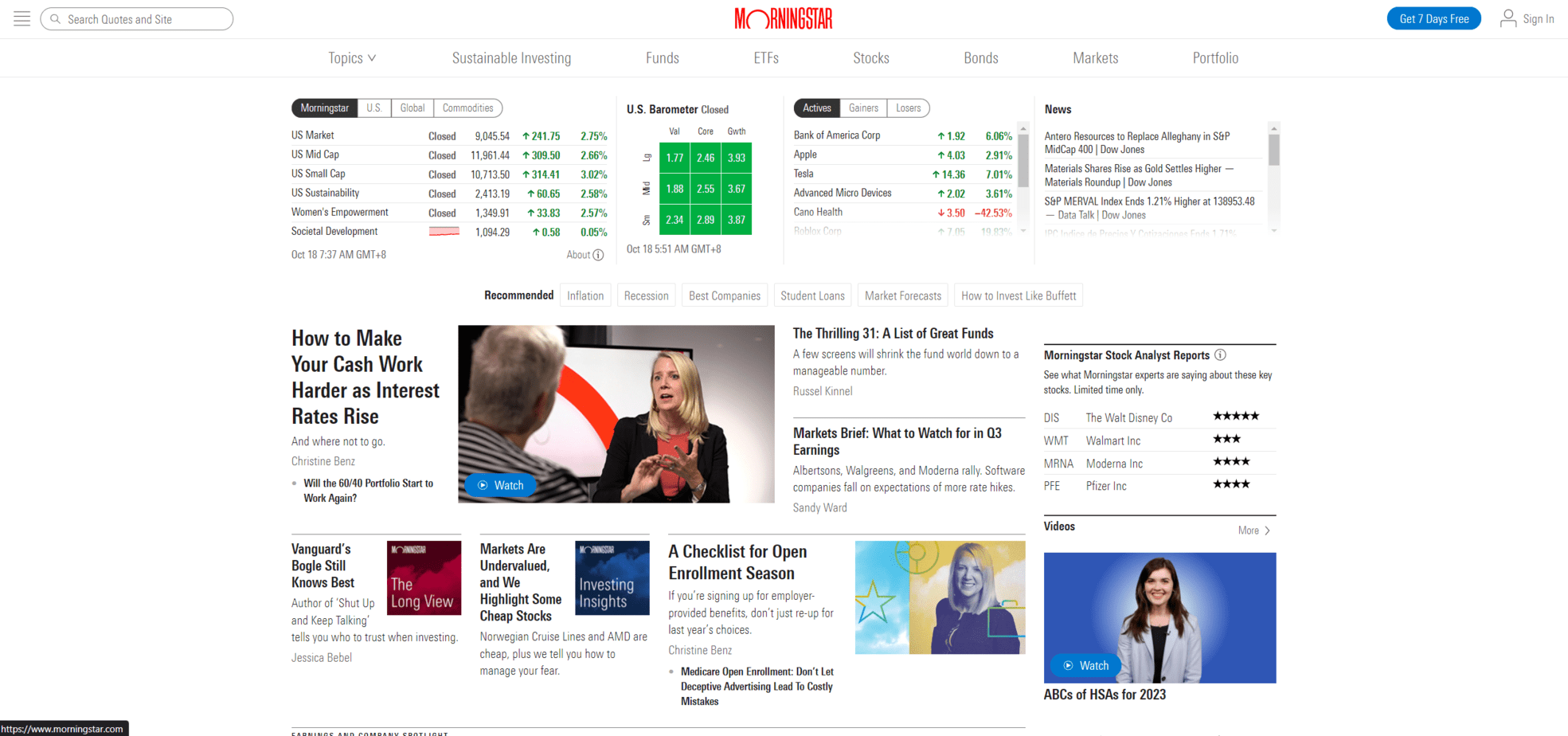

Joining Morningstar is quite easy. First, you need to visit their website, which is “Morningstar.com”. Then, once you’re on the homepage of their website, you’ll find a button in the upper right corner that says “Get 7 Days Free”. Click that button.

Once you click the button, it will direct you to the Subscription Service page of Morningstar. You’ll find a button that says “Start Free Trial”. Click on that.

Then, you’ll need to create an account using your email. You’ll also have to choose your payment plan and payment option. Once you’re done, you are good to go.

Morningstar cost to join

Keep in mind that any person can use the free version of Morningstar. This version usually includes a couple of useful pieces of information. However, it’s not that useful compared to the paid version.

The paid membership of Morningstar offers you tools to track your portfolio, evaluate current investments, and hone your investment skills.

The cost of joining Morningstar is $34.95 a month. This means you’ll pay $419.4 per year. However, you can save money if you choose the yearly plan. The yearly plan only costs $249 per year. That is around 41% of savings compared to the monthly plan.

You can also take advantage of the 7-day free trial of Morningstar Premium if you want to test it out before you pay anything. If you don’t like the service, you can cancel your account before the trial ends.

Morningstar reviews online

Morningstar is an online course that teaches you all there is to know about investing and how you can use it invest your money in the future.

But is it any good?

The only way to know this is to read reviews from people who have tried it by themselves...

Common positive Morningstar reviews

- Incredible amount of data on the platform

- Well-understood methodology

- Ability to create investment portfolios

The following comments below are the common positive reviews you’ll find online:

- “There's an incredible amount of data on the platform, you will get everything you need. The research team in Morningstar also publishes great articles.”

- “Morningstar's large database of mutual fund, ETF, and equity data. Holdings-based and performance data, well-understood methodology for classifying funds across growth/value, and various other categories. Presentation studio is also a great tool for creating investment collateral such as factsheets and nice-looking reports.”

- “Clean interface and easy to navigate. I also loved the ability to create investment portfolios and backtest their performance. At the time of my use, backtesting was only available in Morningstar Direct. This gives you more confidence in your portfolio and allows you to test different allocations for your portfolio.”

Common negative Morningstar reviews

- Looping process

- It is useless

- Difficult to cancel subscription

And here are the best negative reviews I seen:

- “I've tried everything to login and pay for a premium subscription but it just takes all the details and then loops back to the start of the whole process. Have contacted Morning Star, no response. Very poor.”

- “Do not use this service, it is useless. I paid for a premium membership but none of the tools worked and wasted my money. I sent several emails complaining but nothing was done. They offered me a one-month complimentary extension to my premium account as compensation but that did not work either.”

- DO NOT SUBSCRIBE - They are one of those companies that make it as difficult as possible to cancel your subscription - they have conflicting information across the US and UK websites, which seem to be different - it’s so anti-customer in this day and age it’s verging on criminal. I wish I'd read the other reviews on here that say exactly the same thing”

Is Morningstar a scam?

The simple answer is no. Morningstar is not a scam. It’s one of the most useful investment platforms out there. A lot of professional and experienced investors use Morningstar to track and monitor their portfolios.

Morningstar has also been operating for a lot of years. So, you can guarantee that it isn’t a scam. Once you pay the fee, you’ll get access to everything.

Tired of MLMs? Check out how I make money online here!

Morningstar pros

Here are some of the best things that I discovered when reviewing Morningstar...

#1 Thorough

The details contained in the course lessons are thorough yet concise. When you compare them to other investment courses, the lessons in Morningstar courses clearly cover everything you need to know about investing.

You will learn basic investing principles and investing lingo. This will help you have a solid foundation upon which to build investing skills and knowledge.

#2 7-day free trial

Another excellent benefit of Morningstar is its 7-day free trial. Unlike other platforms out there, the free trial of Morningstar will provide access to all of its features and tools.

If you don’t like Morningstar, you can simply cancel the free trial to avoid paying the monthly or yearly fee.

#3 Variety of courses

When you go to the Education page of Morningstar, you’ll find a variety of courses that tackles different topics, from stock investing to ETFs.

With this, you can simply browse this page if you’re looking to learn a particular topic about investing.

Morningstar cons

And here are some of the things I find off in Morningstar. So take note of these...

#1 Lessons are too closely aligned with their services

When you read all the lessons offered by Morningstar, you’ll notice that they are too closely aligned with their services.

The information that you see is biased toward the analytical tools offered by the company. This means that if you want to apply what you’ve learned, you’ll need their tools.

#2 Hard to determine where to start and where to proceed

Don’t know where to start? Well, unfortunately, Morningstar won’t be useful with that. You’re on your own when it comes to learning. You’ll have to find which lessons fit your needs and where to proceed once you’re done.

Morningstar will simply give you the lesson and you’re good to go.

#3 Everything is text

Do you hate reading? If so, Morningstar isn’t for you. Every lesson is text. You won’t find any video or audio lessons. You’ve got to read everything to learn.

So, if you’re a person who prefers learning through watching videos, you might want to look for other courses because Morningstar courses are complete texts.

My opinion - Morningstar

The tools and courses offered by Morningstar are for long-term investors. So, if you’re a swing trader or day trader, then Morningstar isn’t for you.

Also, if you’re looking to learn more about investing in futures, forex, or options, Morningstar is not your best bet because it mainly focuses on Funds, ETFs, and stocks.

That is why it’s best to take advantage of Morningstar’s 7-day free trial to determine if it is really for you.

How I make passive income online

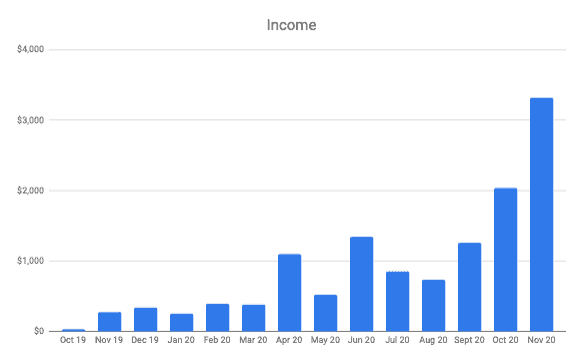

In 2018 I had no idea what affiliate marketing was.

Once I learnt about it, it just seemed like a great business model that can grow over time using the power of the internet.

So I tried to figure it out by myself... that got me nowhere fast.

Then I fell for some terrible online scams.

But eventually, I found Wealthy Affiliate. It teaches long-term proven strategies to build an online business with all the tools & support needed.

And this happened...

Once you learn the process of getting thousands of people to find your website every month (for free) there really is not limit to what you can achieve online.

I've reviewed hundreds of courses or programs that claim to help people make money online. And I've spoken to dozens of 6-7 figure online entrepreneurs on my podcast.

This is by far the best place I've seen to help beginners get set up on the right foot. You can read my full Wealthy Affiliate review here (including the pros and cons!)

Or you can watch an insiders video I made that explains exactly how it works here.