As a trader, do you know what investment appraisal is? Well, for those who don’t know, investment appraisal for traders is a type of fundamental analysis.

It can help traders identify the perceived profitability of a company as well as long-term trends. Investment appraisal is vital for traders since it’s a type of fundamental analysis.

Because of this, it’s able to show a trader whether a company or a stock has long-term potential based on the profitability of its future activities and projects.

Unfortunately, mastering investment appraisal can be difficult. This is where Investment Appraisal Mastery by Udemy comes in. It’s an online course that will teach you the basics and how to master investment appraisal.

However, is this course good? Is it worth your money and time?

Disclaimer:

This Investment Appraisal Mastery review has been thoroughly researched with information and testimonials that are available online to anyone in the public. Any conclusions drawn by myself are opinions.

Investment Appraisal Mastery Review

The overview and rankings

Name: Investment Appraisal Mastery

Founder: Fervent

Type: Investment Course

Price: $99

Best for: Beginners in Investing

Summary:

You might have heard of the Investment Appraisal Mastery course while looking for online investment courses. It’s a course created by Fervent and offered by Udemy.

However, is it a legitimate course or is it a scam? Will it really help you master investment appraisal? Let’s find out.

Make Time Online Rating:

40 out of 100

Recommended: No

What is Investment Appraisal Mastery about?

Investment Appraisal Mastery is an online course offered by Udemy. This course claims to teach students how to gain command over the core skills of investing.

The Investment Appraisal Mastery course claims to help students master one of the most versatile skills in finance.

By becoming an Investment Appraisal pro, you’ll avoid making poor investment decisions and easily recognize the right investment opportunities.

This course does not require prior knowledge. So, even if you’re new to investing or trading, you can still enroll in this course to help improve your skills.

Check out this 3-minute video to know more about this course...

Let us then know who started this all...

Who is Fervent?

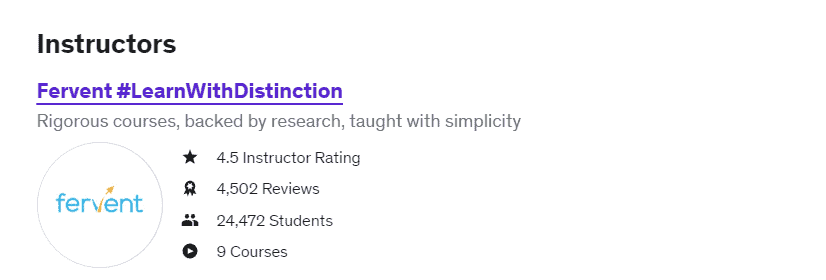

Even though the course is offered by Udemy, they are not the ones who created the course. The creator of the course is Fervent.

Fervent is one of the many instructor partners in Udemy. As of today, Fervent has taught 24,500 students in Udemy with their courses.

Fervent is another online learning provider. According to their website, they’ve got more than 10 years of training and teaching experience.

They mostly focus on teaching complicated concepts of Accounting and Finance.

Fervent also claims that they are one of the most trusted learning providers in the world.

How does Investment Appraisal Mastery Work?

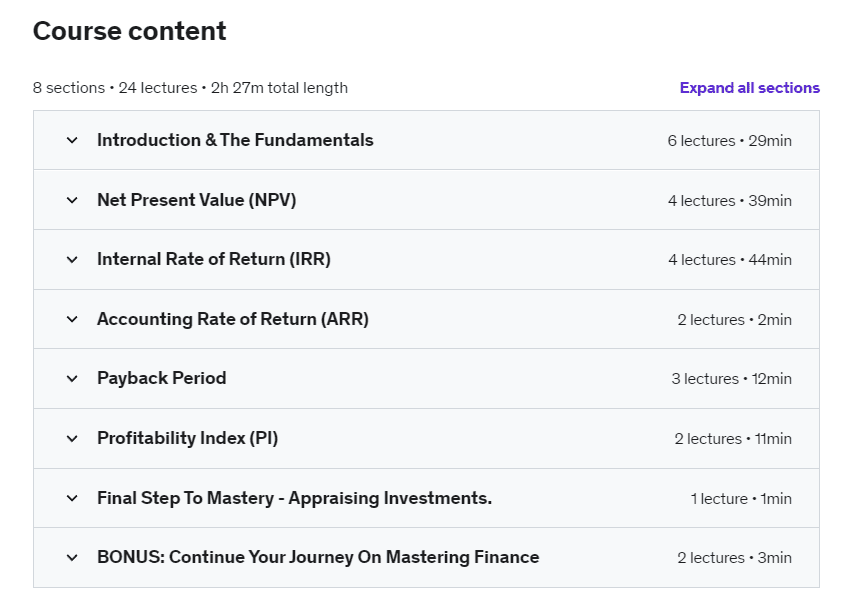

Just like any course out there, the Investment Appraisal Mastery course is divided into several modules. Each module contains various lessons.

In this course, Fervent uses the same proven and tested teaching techniques that have helped their clients become a pro in investment appraisal.

Also, the course does not require prior knowledge of investing. Thus, if you’re a complete beginner, you can still proceed with this course since it starts from the very basics.

However, the course does require you to have paper, a pen, and a calculator when learning the lessons.

Inside Investment Appraisal Mastery

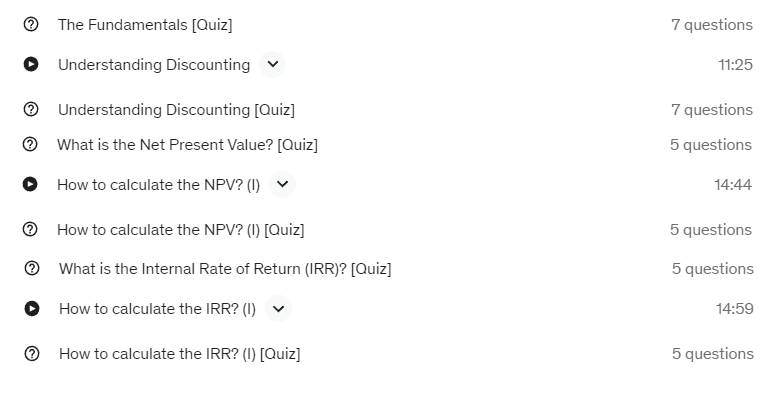

This course is divided into 6 modules that can help you master Investment Appraisal.

You can follow the outline of the course for learning. However, you can also skip some modules if you simply want to learn a specific lesson about investment appraisal.

The modules that you’ll get inside the course include:

Module 1: Introduction and the Fundamentals

This is the first module of the course. In this module, you’ll learn the fundamentals of capital budgeting and the basics of finance.

This course also explains why particular investments appear great at first but are bad down the line.

Module 2: Net Present Value

In this module, you’ll learn why companies across the globe depend on the NPV method when investing a lot of money.

This module will teach you why this capital budgeting method is extremely powerful and versatile. It will also teach you how to manually compute the NPV of projects and how to use Excel to compute it.

Module 3: Internal Rate of Return (IRR)

In this module, you’ll learn the powerful relationship between the cost of capital and the Internal Rate of Return (IRR).

It will also teach you how to estimate the IRR from scratch using various methods. This includes interpolation.

You’ll also learn how to use Excel for computing IRR and Rate functions.

Module 4: Accounting Rate of Return (ARR)

In this module, you’ll learn how simple techniques and strategies aren’t helpful. It explains why they’re extremely risky in investing.

You’ll also learn some of the limitations of this well-known capital budgeting method. At the end of the module, you should be able to distinguish between cash flows and profit.

Module 5: Payback and Discounted Payback

In this module, you will learn why professional investors consider this the easiest capital budgeting method.

This module also contains lessons that will teach you how to estimate when you will make back your initial investment.

In addition to that, this module will also teach you how your payback method is affected by the time value of money.

Module 6: Profitability Index

In this module, you will learn how to pick between two excellent investment opportunities whenever you have limited funds.

This module will also explain why the Profitability Index is perhaps the most useful capital budgeting method out there.

At the end of this module, you should understand the idea behind the formula and the finance fundamentals behind it.

Check out this 9-minute video that gives you

How to Join Investment Appraisal Mastery

Now that you know the content of the course, you might be interested in joining it. Well, lucky for you, joining any Udemy course is quite easy.

First of all, you need to open your favorite browser and go to the website of Udemy, which is Udemy.com.

Once you’re on the homepage of Udemy, you’ll find a big search bar on top. In that search bar, type in “Investment Appraisal Mastery” and hit enter.

Udemy should provide you with a couple of results. However, you’ll need to click the first result. The title of that course should be “Investment Appraisal Mastery - NPV, IRR, Payback, PI, ARR”

After clicking that result, it should direct you to the main page of the course. On the right side, you’ll see a button that says “Buy Now”. Click that button and input your payment details. Then, you’re good to go.

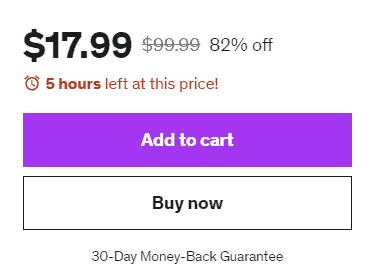

Investment Appraisal Mastery cost to join

The cost to join Investment Appraisal Mastery is only $99.99. When you compare it to other courses online, this course is quite cheap.

However, you should also know that Udemy constantly offers huge discounts on its courses. As of today, the price of the course is only $17.99 because Udemy is offering an 82% discount.

Keep in mind that this discount won’t last long. They only usually last for several hours. So, when you see the price of the course is discounted, you might want to get it as soon as possible.

Investment Appraisal Mastery Reviews Online

Investment Appraisal Mastery is an online course by Fervent that teaches you all there is to know about investing that can help you earn big amount of money.

But is it any good?

The only way to know this is to read reviews from people who have tried it by themselves...

Common positive Investment Appraisal Mastery reviews

- Short and sweet.

- It gives in-depth understanding

- Clear and Concise.

The following comments below are the common positive reviews you’ll find online:

- “Short and sweet. In only 3 hours, the course gives an intuition on how to calculate NPV and IRR, two of the most popular methods of investment appraisal. The lector is clear, articulate, and most importantly, brings the boring subject to life.”

- “This is an excellent course for anyone looking to gain an in-depth understanding of NPV, IRR, Payback Period, ARR, and Profitability Index all of which are mentioned in IFMA's study guides for FMP certification. Having a scientific calculator and/or Excel will help when completing the exercises and quiz at the end of each lecture. The dashboard is user-friendly and the course material is easy to follow. The course material, lecture notes, and Q&As can be downloaded for future reference. Overall, a great experience!”

- “Good course. The lecturer is clear and concise in his explanation. Would have been an even more awesome one if there were links to additional materials/resources on the subject”

Common negative Investment Appraisal Mastery reviews

- Too much manual calculations.

- Certificate may take too long to receive.

- Some Lessons can be found on YouTube.

And here are the best negative reviews I seen:

- “I purchased this course to learn the application of investment appraisal techniques using Excel. Unfortunately, the use of Excel is minimal, mostly manual. Since Excel has got all these with financial formulas there is no point trying to reinvent the wheel by spending time doing manual calculations.”

- “Still waiting for my certification even though I have submitted my assignment”

- “The course is great. However, I noticed that some of the lessons can be found on YouTube. The content is the same, from the equation down to the processes. If I knew that you can learn this by watching YouTube videos, I wouldn’t have paid money for this course.”

Is Investment Appraisal Mastery a scam?

So, is this course a scam? Well, Investment Appraisal Mastery is not a scam. It’s a legitimate course.

Keep in mind that every single course on Udemy is regularly checked. If some instructor publishes a course that is a scam, Udemy will immediately remove it from their platform.

Since this course has stayed on the platform for a long period, it’s safe to say that it’s a real course that teaches valuable lessons.

Aside from that, the creator of the course itself is a well-known online learning provider. You can visit their website to learn more about them.

Tired of MLMs? Check out how I make money online here!

Investment Appraisal Mastery pros

Here are some of the best things that I discovered when reviewing Investment Appraisal Mastery...

#1 Many example lessons

One of the biggest benefits of this course is that every important lesson has example walkthroughs.

Instead of simply watching the instructor explain the lesson in theory, you’ll see a couple of examples to help you understand how everything works in real life.

#2 Useful quizzes

Every module of this course contains quizzes that you need to answer before you can proceed to the next lesson.

Of course, you can just skip these quizzes if you don’t want to answer them. However, they can be extremely useful since they can evaluate how much you’ve learned.

In addition to that, after answering all the questions, you’ll receive all their detailed solutions. Thus, you can review your answers to see if you’re using the right methods.

#3 Reputable companies use this course

You know that a course is good when some of the most well-known companies across the globe use it to teach their employees.

This is also the case with Investment Appraisal Mastery. Well-known companies have been using it to teach their employees about investment appraisal.

Investment Appraisal Mastery cons

And here are some of the things I find off in Investment Appraisal Mastery. So take note of these...

#1 Some lessons are in YouTube

If you don’t want to pay $99.99 for this course, you can learn it by simply searching the lessons manually on YouTube. You can find tons of videos out there with the same content for free.

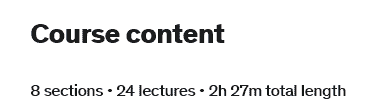

#2 A bit too short

To complete the entire course, you’ll only need 2 hours and 30 minutes. Of course, this is quite short for a training program.

If you’re paying $99.99 for this course, you want to get the most out of it. Knowing that you can finish it within 3 hours means that the lessons might not be that useful.

#3 Bonus module is very promotional

When you enroll in a course, having a bonus module can be extremely useful. This is particularly true when it provides additional lessons to help further improve your knowledge.

Unfortunately, that is not the case with this course. The bonus module is simply a promotion for the other courses that the instructor provides.

My opinion - How to Not Suck at Investing

Does the How to Not Suck at Investing course work?

The answer is yes. It’s a short course that will enable you to learn the basics and fundamentals of investing.

However, it’s only great for beginners. If you want to improve your investing skills, you’ll need to look for other courses out there...

How I make passive income online

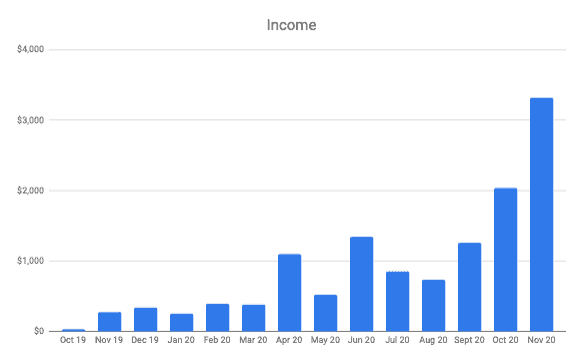

In 2018 I had no idea what affiliate marketing was.

Once I learnt about it, it just seemed like a great business model that can grow over time using the power of the internet.

So I tried to figure it out by myself... that got me nowhere fast.

Then I fell for some terrible online scams.

But eventually, I found Wealthy Affiliate. It teaches long-term proven strategies to build an online business with all the tools & support needed.

And this happened...

Once you learn the process of getting thousands of people to find your website every month (for free) there really is not limit to what you can achieve online.

I've reviewed hundreds of courses or programs that claim to help people make money online. And I've spoken to dozens of 6-7 figure online entrepreneurs on my podcast.

This is by far the best place I've seen to help beginners get set up on the right foot. You can read my full Wealthy Affiliate review here (including the pros and cons!)

Or you can watch an insiders video I made that explains exactly how it works here.