Investing is simple. However, it is not easy. It’s incredibly complicated, especially when you consider the recent market volatility.

When you want to start investing, you need to consider a couple of things. When is the best time to invest in stocks? What is the ideal asset allocation? Which fund managers will beat the market?

If you invest and have no idea what you’re doing, you’ll lose a lot of money—because of this, learning the fundamentals of investing is essential before you start.

So, where can you learn the fundamentals of investing? One way to do it is to enroll in an online course. One course you can consider is Fundamentals of Investing.

However, is it a good course? Is it legit, or is it a scam? Let’s find out!

Disclaimer:

This Fundamentals of Investing review has been thoroughly researched with information and testimonials that are available online to anyone in the public. Any conclusions drawn by myself are opinions.

Fundamentals of Investing Review

The overview and rankings

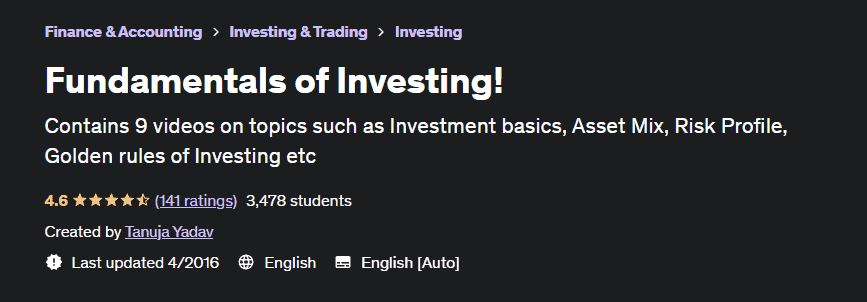

Name: Fundamentals of Investing

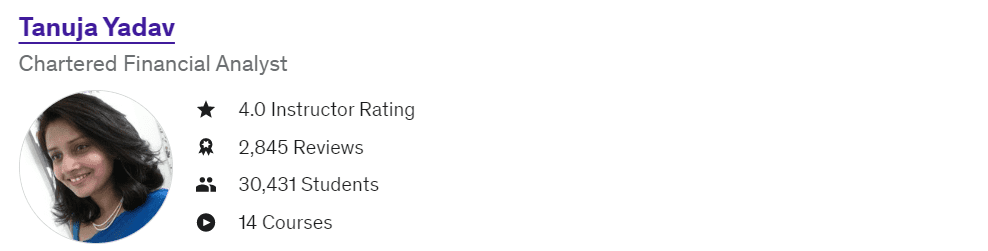

Founder: Tanuja Yadav

Type: Investing Course

Price: $19.99

Best for: Beginners in Investing

Summary:

If you’re looking for an investment course for beginners, you have probably come across Fundamentals of Investing in Udemy. However, is it worth your time and money? In this review, you’re going to find out.

Make Time Online Rating:

35 out of 100

Recommended: No

What is Fundamentals of Investing about?

As the name implies, Fundamentals of Investing is an online course that teaches you all the fundamentals of investing.

It’s a beginner-friendly course primarily aimed at beginners who want to understand the concept of investing better.

In addition, this course is offered by Udemy. Udemy is one of the most reputable and reliable online education platforms for those who don't know. Thus, you can guarantee this course is real and legit.

Check out this 7-minute video to know more about this course...

Let us then know who started this all...

Who is Tanuja Yadav?

Tanuja Yadav is the creator and instructor of the course. According to her Udemy profile, she is a certified Chartered Financial Analyst.

Tanuja also claims in her profile that she has extensive experience in finance and accounting outsourcing and has worked on different projects.

According to Tanuja, she has 17 years of experience in finance and accounting practice and process improvement, handling end-to-end finance and accounting processes, and finance and accounting delivery.

She specializes in fraud risk assessment, SOX testing, solution development, fixed asset and project accounting, reconciliation, FinTech, and more.

As of today, Tanuja has offered 14 courses on Udemy. She also has more than 30,431 students.

How does Fundamentals of Investing Work?

The Fundamentals of Investing course is an online training program that will teach you the basics of investing.

This online training program will teach you the basics of investing, including choosing stocks, bonds, and mutual funds. You'll also learn about risk management and portfolio diversification.

In addition, the course will cover essential topics such as taxes and investment strategies. By the time you finish the course, you'll have a solid understanding of the basics of investing.

In addition, this course is beginner friendly. You don’t need any prior investment knowledge to take this course.

However, Tanuja recommends this course for anyone planning to start a career in banking or finance or people who want to handle their investments.

This course also benefits people who want to understand the jargon of investing.

Inside Fundamentals of Investing

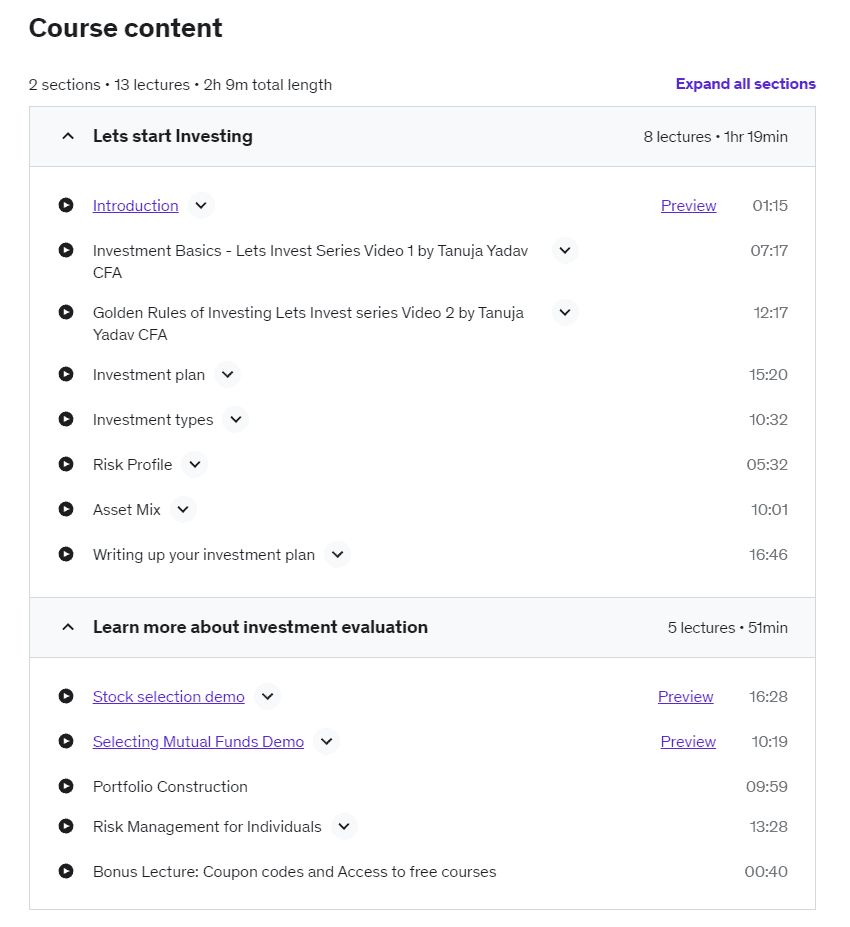

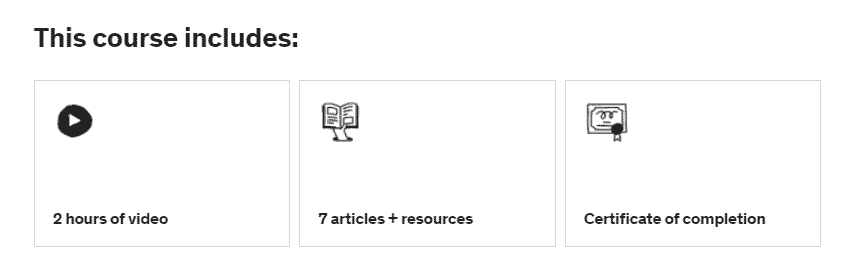

The Fundamentals of Investing Course is relatively short compared to other online investing courses. You will only need 2 hours and 9 minutes to finish the content.

In addition, the course only contains two modules and 13 lessons. Thus, you can probably finish this course in one day.

Module 1: Let's Start Investing

The course's first module is titled “Let’s Start Investing.” However, you should not fall for it because you won’t invest any time soon.

In this module, you will simply learn a couple of lessons. The first lesson is the introduction. It’s a 1-minute video that simply offers a preview of what you should expect in that module.

Once you’re done watching the introduction, you can proceed with the next lesson to start learning.

The second lesson is called Investment Basics. It’s a 7-minute video that will offer you an introduction to financial markets.

The third lesson is called the Golden Rules of Investing. It’s a 12-minute video about the golden rules you must follow as you begin your investing journey.

The fourth lesson is called Investment Plan. It’s a 15-minute video that will help you understand the basic content of an investment plan. In this module, you’ll also learn how to create financial goals.

The fifth lesson is called Investment Types. In this 10-minute video, Tanuja will explain the basic types of investments. She will also teach you the risk and return categories of each type.

The sixth lesson is called Risk Profile. It’s a 5-minute video that will teach you how to determine your ability to take investment risks.

The seventh lesson is called Asset Mix. It’s a 10-minute video that shows you how to determine your best asset mix.

The eighth lesson is called Writing up your Investment Plan. As the name implies, this 17-minute video will teach you how to create your investment plan from scratch.

Overall, the first module contains eight lessons; you will need at least 1 hour and 19 minutes to finish it.

Module 2: Learn more about investment evaluation

The second module of the course is called Learn More About Investment Evaluation. This module contains five lessons; you will need at least 51 minutes to finish them.

The first lesson is called Stock Selection Demo. It’s a 16-minute video that shows you a demo of how to choose stocks correctly. In addition, you’ll also learn the basic criterion that you need to meet to select stocks.

The second lesson is called Selecting Mutual Funds Demo. Another demo video shows you how to choose mutual funds for investments. It’s a 10-minute video that will also provide you with the basic criterion you need to assess before you invest in any mutual fund.

The third lesson is called Portfolio Construction. As the name suggests, this lesson will teach you how to construct your portfolio correctly. It’s a 10-minute video.

The fourth lesson is called Risk Management for Individuals. It’s a 13-minute video that teaches you how to manage investing risks. This is one of the most critical lessons in the course. Thus, you should not skip it.

The fifth lesson is simply a bonus lesson. It contains coupon codes that discount Tanuja’s other courses in Udemy. In addition, this bonus lesson will also give you access to her free courses.

So, technically, module 2 only contains four lessons.

Check out this 12-minute video that gives you a glimpse on this course...

How to Join Fundamentals of Investing

Now that you know what’s inside the course, you’re probably interested in joining this training program. Luckily, it is offered on Udemy. Thus, joining this course is relatively easy.

First, you need to visit Udemy.com. Once you’re on the homepage of Udemy, click on the search bar at the top of the page, type in “Fundamentals of Investing,” and hit enter.

Once that is done, it should direct you to the results page, and the first result should be the course you’re looking for. The title should be identical. If so, click on that link.

Once you’re on the course’s page, you’ll see a button on the right that says “Buy Now.” Click that button, type in your payment information, and you’re ready.

Fundamentals of Investing Cost to Join

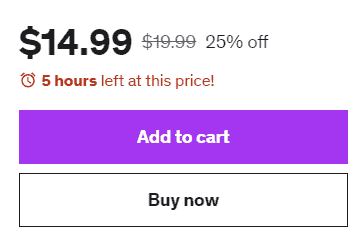

The cost to join this training program is $19.99. However, Udemy regularly offers a course discount that lasts only several hours.

Thus, check this course regularly to see if it’s discounted. Today, Udemy offers 25% off, making the price $14.99.

Fundamentals of Investing reviews online

Fundamentals of Investing is an investing course that teaches you all there is to know about Investing and how you can use it to and earn money in the future through stocks.

But is it any good?

The only way to know this is to read reviews from people who have tried it by themselves...

Common Positive Fundamentals of Investing reviews

- It's great resource for new investors

- Very helpful course for novice individual investors

- The notes are great touch

The following comments below are the common positive reviews you’ll find online:

- “Having done some really basic investing thus far, some of the content was a bit redundant. However, there are some jewels in the first half of the videos. I had to sift through it a bit and find new information but it is a great resource for new investors and even those who have not yet begun investing.”

- “Very helpful course for novice individual investors/ retail investors. Also, it is helpful to understand how a fund manager/ broker works. I felt more comfortable talking about investments after learning what to look for and confirmation of known pitfalls. North Americans sometimes have trouble with Indian accents. Her accent was fine for me. I got used to it quickly enough and understood her points without rewinding.”

- “I like the amount of detail that you talked about where and how to invest, along with different ways that you invest. Aligning your goals and risks depending on your investing type works. It's a good head-start to the interesting world of business! The notes are a great touch, so I can focus on listening instead. Keep it up, Ms. Tanuja!”

Common Negative Fundamentals of Investing reviews

- Charts should be clearer

- This course is just advices

- Waste of time and money

And here are the best negative reviews I seen:

- “So far, it’s common sense. People should already know this. I am looking to learn how to earn charts for companies. The stock selection Demo alone is worth watching the lecture. I just wish the chart was clearer and the explanation of the chart was slower.”

- “From what I've seen so far, this course should be called "advice before you invest", I am looking for investment basics (e.g., what are equities, annuities, the types of accounts, etc). Thanks!”

- “I felt that this was a waste of time and money. So very basic. It is what I knew in 9th grade. Key points: don't put all your eggs in one basket? Really? Avoid scams. Don't borrow money to invest. Extremely basic learn more from google search. Don't pay for this course, it was vague and not full of any info that a jr. high students would know. A waste of time and money 10.00 for ten minutes. Use google or watch Bloomberg. I do not advise anyone to take this course. Use YouTube.”

Is Fundamentals of Investing a scam?

Fundamentals of Investing is not a scam. It’s an actual course that contains valuable information. Once you pay the price, you’ll get access to the course’s content immediately.

Note that Udemy offers this course. Udemy does not allow scammers to sell courses on their platform. So, every course you find on Udemy is legit.

Tired of MLMs? Check out how I make money online here!

Fundamentals of Investing Pros

Here are some of the best things that I discovered when reviewing Fundamentals of Investing...

#1 Understand the basics of investing

This course will teach you the basics of investing, including how to choose investments, how to monitor your portfolio, and how to reduce risk.

In addition, the course will also help you understand the different types of investment vehicles, such as stocks, bonds, and mutual funds.

#2 Get a certificate of completion

Once you finish the course, you can get a certificate of completion. This certificate can be pretty valuable when applying for a job relevant to this course.

#3 It's beginner-friendly

If you’ve zero knowledge about investing, this course is for you. You don’t need any prior knowledge. It’s made for beginners.

Fundamentals of Investing Cons

And here are some of the things I find off in Fundalementals of Investing... So take note of these...

#1 You can find all lessons online

You don't need this course if you know how to use Google. You can find all information in this course on Google and YouTube for free.

#2 It's outdated

This course is quite old. According to its page, it was last updated in 2016. Thus, the content of this course is also outdated.

#3 It's very short

Two hours is short if you want to learn the basics of investing. You need to know tons of fundamentals, and 2 hours won’t be enough for them.

My opinion - Investing Success

I don’t recommend this course. Even though it’s pretty cheap, it is still not worth it. Aside from the fact that you can find its content online for free, it’s also outdated.

If you do your own research, you can find updated and new information online. It’s not that hard since tons of resources are available today for free.

How I make passive income online

In 2018 I had no idea what affiliate marketing was.

Once I learnt about it, it just seemed like a great business model that can grow over time using the power of the internet.

So I tried to figure it out by myself... that got me nowhere fast.

Then I fell for some terrible online scams.

But eventually, I found Wealthy Affiliate. It teaches long-term proven strategies to build an online business with all the tools & support needed.

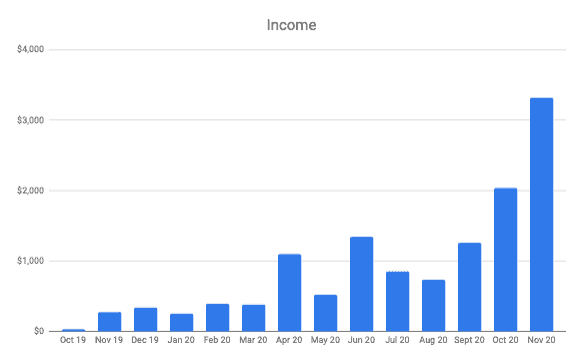

And this happened...

Once you learn the process of getting thousands of people to find your website every month (for free) there really is not limit to what you can achieve online.

I've reviewed hundreds of courses or programs that claim to help people make money online. And I've spoken to dozens of 6-7 figure online entrepreneurs on my podcast.

This is by far the best place I've seen to help beginners get set up on the right foot. You can read my full Wealthy Affiliate review here (including the pros and cons!)

Or you can watch an insiders video I made that explains exactly how it works here.